Supporting you to make the right decision for you

Whether you’re getting ready to take your pension savings, or only just starting to think about retirement, you have more control over your savings in your RSA pension schemes than you might think.

With the pension flexibilities, you can make your money work for your personal situation and your plans. You have a series of choices to make and this website can help you think about what might be right for you.

- Start your journey by following our 3-step plan

- Watch our explainer video on the right

- Compare your options with the Retirement Options tool

Watch the explainer video

Get a quick overview of all of your available options. Our video will help you explore your options with confidence.

Step 1. Consider your priorities

What’s your retirement dream?

When you retire, you’ll need enough of an income to cover your outgoings and to keep buying the things you need or want. It's important to make sure you take your retirement savings in the most appropriate way for you.

We recommend you speak to an FCA-Registered Financial Advisor to help consider your options.

Get some inspiration from our example members.

Step 2. Explore your options

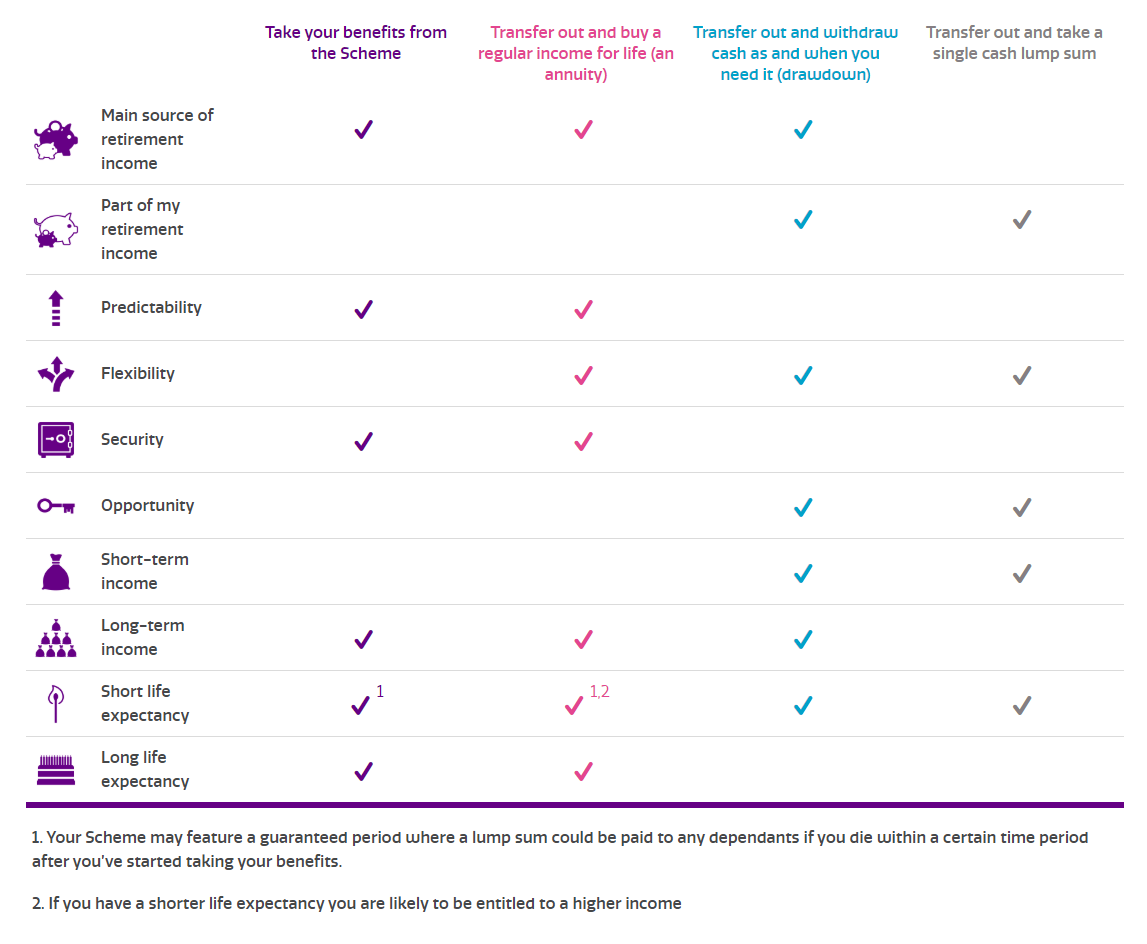

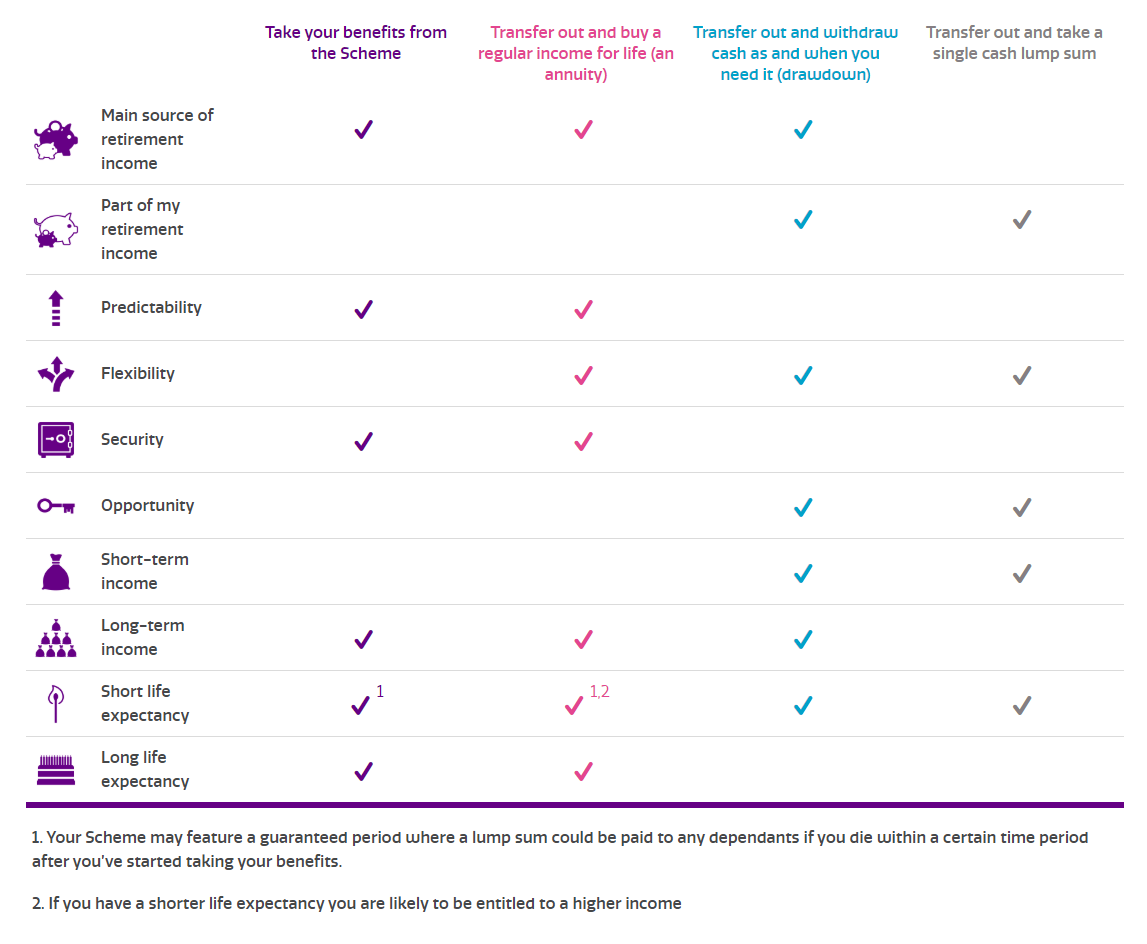

Here are your options at a glance

Take your benefits from the RSA pension schemes

At a glance

- A regular, guaranteed income for life

- Typically increases in value to help protect against increases in the cost of living (inflation)

- An income for your spouse if you die before them

- The option to take a smaller monthly pension in exchange for a tax-free cash lump sum

- The Pensions Regulator believes, for most members, it’s likely in their best financial interests to take a pension from the scheme

- Limited flexibility to tailor benefits to suit your needs

Or, transfer your benefits away from the Scheme

At a glance

- A pot of cash (a transfer value) to secure a retirement income outside of the schemes which can be tailored to suit your needs

- The option to increase or reduce protection for your spouse

- The option to take more cash upfront

- You need to be aware of pension scams (read more here)

- You’ll need to manage your money to make sure it lasts for the rest of your life

- If your funds are invested following transfer, you will take on investment risk and pay ongoing investment charges and advice charges

- You could end up paying more tax if you take your money all at once

If you transfer your benefits out of the scheme

Please be aware that if your transfer value is over £30,000 (excluding any DC benefits/AVCs) you will need to take financial advice before you can transfer out to a DC arrangement. You should ensure that the financial adviser you use is registered with the Financial Conduct Authority (FCA).

You can use that transfer value to buy a guaranteed regular income (an annuity), take it a bit at a time (drawdown), take it all as cash, or mix and match. Regardless of the option you choose, you’re able to take up to 25% of your transfer value, as a tax-free cash lump sum.

We’ll colour code these options the same way throughout the site so you can navigate the site easily.

Transferring out cannot be reversed so make sure you understand the risks and benefits, this FCA webpage and FCA video provide additional information that can help you understand the option and what you could be giving up. You should also be aware of potential pension scams (you can read more here) and only transfer out to a reputable provider. Speaking to an FCA-Registered Financial Adviser can help. As a rule of thumb, if something sounds too good to be true, it probably is.

You’ll find an estimate of your pension benefits in your Retirement quote. Once you’ve read through these details, type the figures provided into the at retirement tool to see what the different options could mean for you. If you do not have a retirement quote and are over age 55, you can request one from the schemes’ Administrator, Willis Towers Watson.

The Money Helper website also provides some tools to help with your options, including a pension calculator and annuity comparison tool which you can access here.

(A) regular income for life

Transfer out and buy a regular income from an insurance company.

- A guaranteed income for the rest of your life, called an Annuity

- Choose the level of benefits to match your priorities

- A possible higher income if you have health issues

- You’ll need to shop around to get the best deal

- Depending on the benefits you choose, the annuity may not provide protection for your dependants or against the effects of increases in the cost of living (inflation)

(B)it at a time

Transfer out and withdraw cash as and when you need it.

- Take your money as and when you need it, called Drawdown

- If you die before 75, savings can often be passed tax-free to your Spouse or financial Dependant

- You’ll need to ensure your money lasts as long as you need it (estimate your life expectancy here)

- No guaranteed income for your retirement; you’ll need to take on investment risk and pay ongoing investment and advice charges.

(C)ash out

Transfer out and take a single cash sum lump sum.

At a glance

- Take all your benefits as a Cash lump sum

- You’ll be taxed on 75% of the amount you take, possibly at a higher level than you’re used to if you take it all at once

- No guaranteed income for your retirement; you’ll need to ensure your money lasts as long as you need it to.

Which option is right for you? – Compare your options

Mix-and-match your options

Should you wish to, you can mix-and-match from the options above.

For example you can take some cash up front, buy an income for life to cover the basics and draw down the rest. It’s entirely your choice.

You should to speak to a Financial Advisor if you are considering this.

Compare options side-by-side

Please click or tap the image below.

Play with the Retirement Options tool

The Retirement Options tool is for deferred members approaching retirement and who are eligible for a retirement quote. Once you’ve got that quote, you can compare your Scheme Pension against taking a transfer and using the flexible retirement options instead.

Up to 25% of your lump sum may be paid tax free, but you’ll pay tax on the remainder – potentially pushing you into a higher tax bracket as your income is not spread out.

Step 3. Make your decision

This is a big decision. It’s important to have all the information you need to make it.

Helping you make a decision

Once you have an idea of which of the available options you think may work best for you, we strongly recommend that you get guidance and/or advice if you’re thinking about transferring your pension. In fact, if your transfer value is £30,000 or larger, you have to take advice from an FCA authorised financial adviser to transfer out of the Scheme.

Advice

While the decision on whether to take financial advice is a personal one, there are some circumstances in particular where taking advice, instead of, or as well as, guidance, may be appropriate.

Examples of such circumstances include:

- You have a large pension account

- You have complex income requirements in retirement

- You currently live overseas or you are planning to move abroad

- You have significant other assets outside of your pension arrangement (excluding your own home)

- You are in serious ill-health

- You have complex debts to manage.

This advice must be provided by a person who is appropriately regulated by the Financial Conduct Authority (FCA). This register shows firms that are regulated to provide advice or pension products.

Guidance

MoneyHelper is available to provide information about defined benefit schemes.

There is a lot of information available on their website or you can talk with them by:

- Calling their helpline: 0800 011 3797 (from 9am to 5pm, Monday to Friday)

- Webchat (available 9am to 6:00pm, Monday to Friday. Select ‘Talk to us live’ from the right side of their webpage.

Made a decision?

If you’re ready to do something and choose from one of the available options.

Receive your pension from the RSA pension schemes

You can find details on how to take your pension in your Retirement Pack. Fill out all of the relevant forms you’ll find in your pack and return them to us with any additional documents we need - and we’ll set this up for you.

Please pay particular attention to Form 1 – Your retirement decision where you need to choose either Option 1 – Cash + reduced pension or Option 2 – Full pension.

Or, transfer your pension away from the RSA pension schemes

If you want to transfer out of the Scheme please complete the relevant forms in the Transfer Section of your Retirement Pack, or the forms in your Transfer Pack if received separately, and return to us with the additional documentation we need and we will be able to progress your transfer.

Please pay particular attention to Form 1 – Your retirement decision where you need to choose Option 3 – Transfer.

Not ready yet?

No worries, you don’t have to do anything if you do not want to. These options will be available in the future for when you are ready to start receiving your RSA pension schemes benefits.