Meet Privani

Privani wanted flexibility to take her money a bit at a time, changing how much she took and when. After taking financial advice and confirming that this was the right thing to do, she transferred out of the Scheme and took Drawdown.

Privani is used to making investment decisions and knows about the ongoing investment charges. She has a guaranteed income, from other sources to meet her basic needs.

Privani’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Does this option meet your needs?

We don’t regularly think about the financial implications of getting older, such as the possibility of needing care or how long you’ll live for. But as you approach later life and need to make a decision about your retirement income, it is important to think ahead.

Only you know your financial circumstances – for example, whether loans or mortgages still need to be paid off and the sort of needs you may have later on.

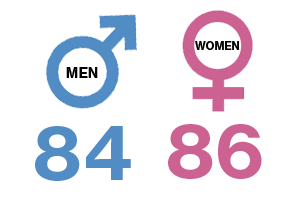

On average people in the UK, aged 65 now are expected to live until*:

Work out your life expectancy with the Government's calculator here

Things to consider

Here are some things to help you consider which options will be right for you. The items highlighted in blue are the most relevant when considering withdrawing cash as and when you need to through drawdown:

Your RSA pension schemes benefits are your main or only source of retirement income

Investing in a drawdown fund will not provide you with a regular, secure income and you will need to monitor your withdrawals and investments carefully to ensure you have sufficient income throughout retirement.

Or, you have other sources of retirement income in addition to your RSA pension schemes benefits

You may prefer drawdown if you:

- Are not reliant on the income from your RSA pension schemes pension for your retirement, and/or

- Are able to afford to take more risk.

You prefer predictability

You can take a regular amount from the drawdown fund or vary the amount that you withdraw each year. However, you will need to manage your withdrawals to ensure you have sufficient income throughout retirement

Or, you prefer flexibility

You can use the drawdown fund to suit your personal circumstances throughout retirement – for example by leaving the fund invested, by making withdrawals, or by using the fund to purchase an annuity at a later stage

You prefer security

- Investing in a drawdown fund will not provide you with a regular, secure income

- The value of your fund may fall as well as rise and poor investment performance and/or excessive withdrawals may result in insufficient funds to support you throughout retirement

Or, you prefer opportunity

You have the opportunity to increase your retirement savings by leaving them invested.

However, you should remember that the value of your fund may fall as well as rise and that this may affect the amount you are ultimately able to withdraw

You prioritise short-term income

- You can take up to 25% of your fund as a tax-free cash lump sum

- You can also choose to take a larger income upfront – however, this may result in you paying more tax and will leave fewer funds available for your long-term income needs.

Or, you prioritise long-term income

You can use the drawdown fund to provide a regular long-term income, or alternatively withdraw funds as and when you need them.

Excessive withdrawals and/or poor investment performance may decrease the value of your fund and affect your long-term income.

You have a short life expectancy

- You have access to your fund to spend on your priorities before you die

- When you die, any pension savings remaining in your drawdown fund can be passed on to beneficiaries of your choice.

Or, you have a long life expectancy

- You have the flexibility to withdraw funds as and when you need them throughout retirement

- You will need to carefully consider the amount of funds you withdraw to ensure you have sufficient funds to last throughout retirement

- Because income is not guaranteed, you may need to think about other sources of income as the value of your fund will fall and rise.

Tax

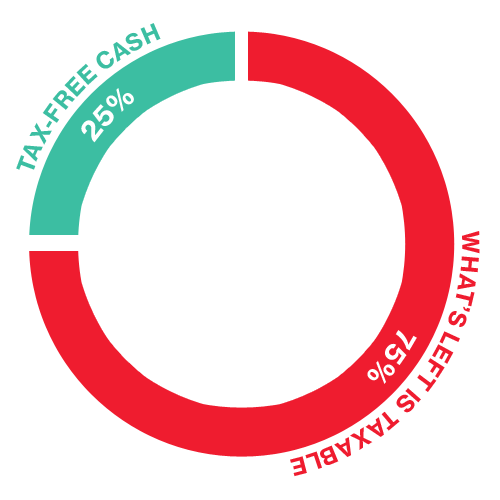

Tax-free cash lump sum

- You can take some of your benefits as tax-free cash, usually:

- Up to 25% of the total benefit value when you initially move to drawdown, or

- Up to 25% of each withdrawal throughout your retirement.

- The amount payable as tax-free cash is restricted by the Lump Sum Allowance (LSA) set by the Government (see below).

Income (subject to tax)

- Withdrawals above your tax-free cash allowance will be taxed at your marginal rate of income tax for the year in which you make the withdrawal

- You won’t pay tax on investment returns within your Drawdown fund.

When should you take tax-free cash with drawdown?

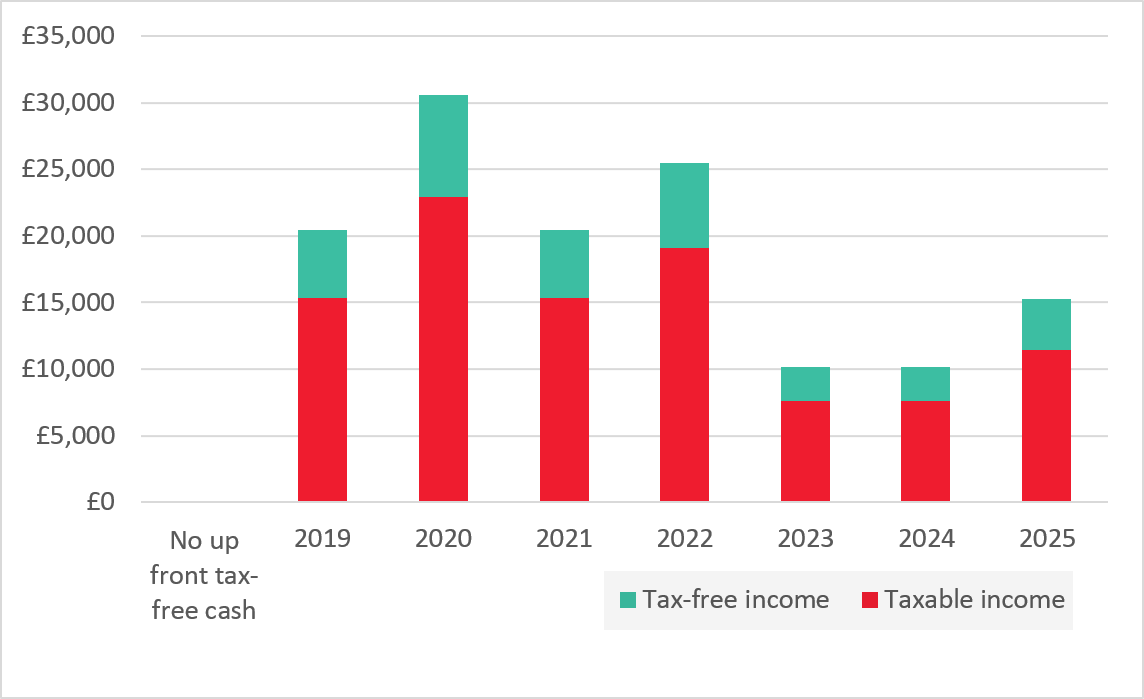

When you enter into drawdown you have the option to either take a quarter (25%) of your benefits up front as a tax-free cash lump sum, or you can take a quarter (25%) of each withdrawal you make tax-free. Whether you choose one way or the other will depend on your personal circumstances and tax position, so it’s worth speaking to an IFA for advice.

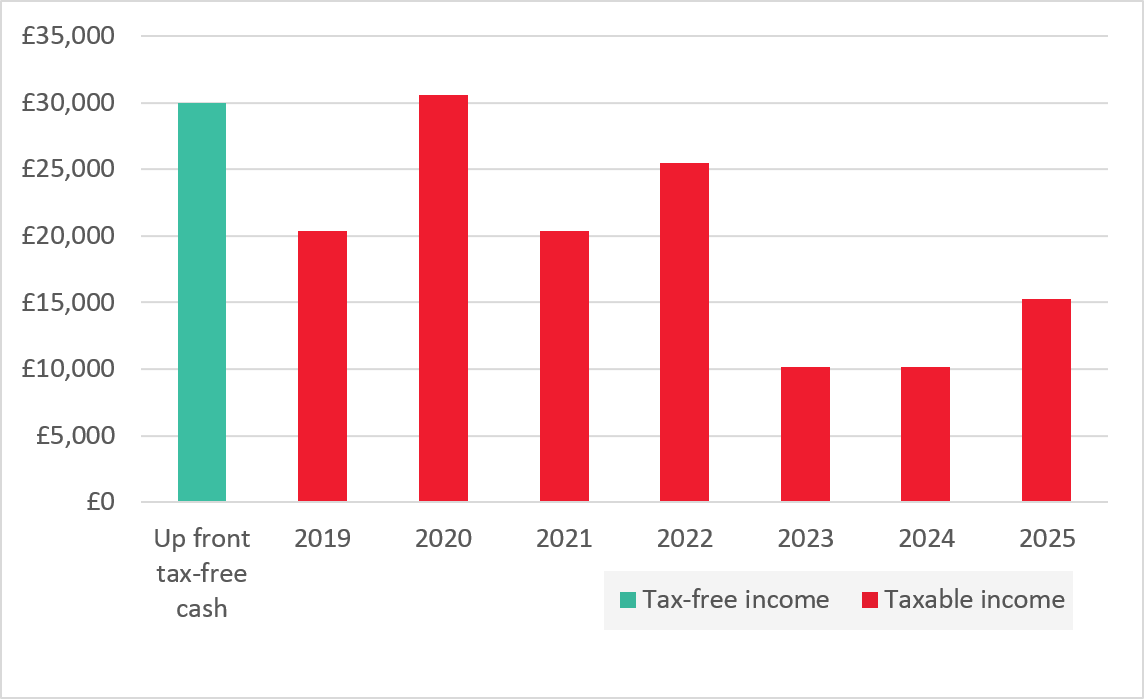

One-off tax-free cash up-front – a quarter (25%) of your benefits

No up-front cash. A quarter (25%) tax-free cash from each withdrawal instead

Lump Sum Allowance (LSA)

The most you can usually take as a tax-free lump sum from all pension arrangements of £268,275 – this is known as the lump sum allowance (LSA). If you have lifetime allowance protection, the amount of tax-free cash you can take may be higher.

If you take a lump sum that goes above your LSA, you’ll need to pay Income Tax, at your marginal rate on the extra amount.

There is also a maximum tax-free amount, currently £1,073,100, called the lump sum and death benefit allowance, that applies to you and your beneficiaries in certain circumstances. This amount includes any tax-free lump sums payable at retirement and certain lump sum death benefits.

For further information about these lump sum allowances, visit the Government website here.

Remember the lump sum allowances are set by the Government and could change.