Meet Harold

What was important to Harold was a regular income each month, similar to the Scheme pension, but tailored to better suit his circumstances. Harold took financial advice and was recommended to transfer out of the Scheme and buy an annuity from an insurance company.

Harold’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Does this option meet your needs?

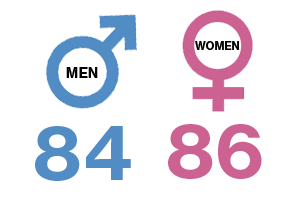

We don’t regularly think about the financial implications of getting older, such as the possibility of needing care or how long you’ll live for. But as you approach later life and need to make a decision about your retirement income, it is important to think ahead.

Only you know your financial circumstances – for example, whether loans or mortgages still need to be paid off and the sort of needs you may have later on.

On average people in the UK, aged 65 now are expected to live until*:

Work out your life expectancy with the Government's calculator here

Things to consider

Here are some things to help you consider which options will be right for you. The items highlighted in magenta are the most relevant when considering an income for life through an annuity:

Your RSA pension schemes benefits are your main or only source of retirement income

As with your RSA pension schemes benefits, buying an annuity provides a secure, regular income, but has the added flexibility of allowing you to tailor your income choices to your particular circumstances.

Or, you have other sources of retirement income in addition to your RSA pension schemes benefits

Instead of an annuity, you may prefer one of the other options for taking my benefits if you:

- Are not reliant on a regular income; and/or

- Are able to afford to take more risk

You prefer predictability

You know how much income you’ll receive, for the rest of your life.

Or, you prefer flexibility

- You have some flexibility to buy an annuity to suit your personal circumstances, such as your health or marital status

- However, once you buy an annuity, you cannot normally change this choice in the future.

You prefer security

Your annuity will provide you with a regular, secure income for life.

Or, you prefer opportunity

Once your annuity starts, your income and benefits are fixed, so there is no opportunity to grow them any further through investments.

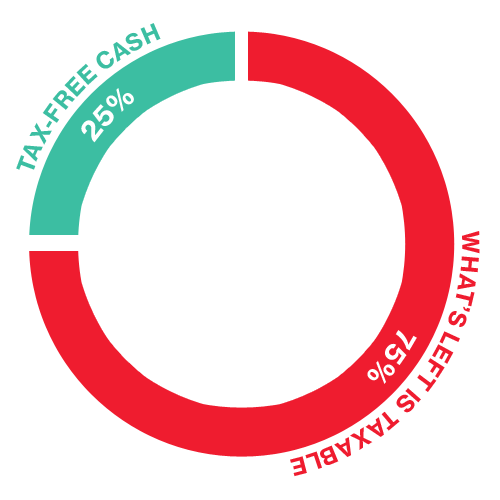

You prioritise short-term income

- While you have the option to take up to 25% of your benefit value as a tax-free cash lump sum on retiring, you cannot access all of your pension income upfront

- If you take the tax-free cash lump sum upfront, your long-term income will be lower to take this into account.

Or, you prioritise long-term income

You will receive a regular, secure income for the remainder of your life.

You have a short life expectancy

- If you (and your spouse or civil partner if you buy a spouse’s pension) die early, your pension benefits would be lost and your pension would not normally be passed onto the next generation

- If you qualify for enhanced terms you may be able to get a higher regular income than you would’ve otherwise received from the RSA pension schemes.

Or, you have a long life expectancy

An annuity will provide you (or your spouse or civil partner if you buy a spouse’s pension) with a steady income for life.

Income for life (annuity) options

What are your options if you buy a regular income for life (an annuity)?

| Feature | Option 1 | Option 2 | Comparison |

|---|---|---|---|

| FeaturePension increases | Option 1An income which increases during retirement, either at a fixed rate or based on inflation. This is known as an ‘increasing annuity’. |

Option 2An income which remains level throughout retirement. This is known as a ‘level annuity’. |

Comparison

|

| FeatureSpouse’s pension | Option 1An income which continues to be paid to your spouse or civil partner upon your death (at a reduced level). This is known as an ‘joint life annuity’. |

Option 2An income which ceases on your death. This is known as a ‘single life annuity’. |

ComparisonAn annuity which includes an income for your spouse or civil partner after your death will be lower than an annuity paid just to you, as it is expected to be paid for longer. |

| FeatureGuarantee period | Option 1An income which stops on your death (or the death of your spouse or civil partner). This is known as an annuity with ‘no Guarantee period’. |

Option 2An income which is guaranteed to be paid for a minimum period. This is known as an annuity with a ‘Guarantee period’. |

Comparison

|

| FeatureHealth / enhanced terms | Option 1An income which does not take into account your health. This is known as a ‘standard annuity’. |

Option 2An income which takes into account your health. This is known as an ‘enhanced annuity’. |

Comparison

|

Tax

Tax-free cash lump sum

- You can take some of your RSA pension schemes benefits as tax-free cash (usually up to 25% of the benefit value)

- The amount you could take depends on the value of benefits you transfer out of the RSA pension schemes and is subject to the Lump Sum Allowance (see below).

Income (subject to tax)

- Your annual income will be taxed at your marginal rate of income tax for that year

- As your annuity income is stable, you can expect to pay a similar level of tax each year (subject to any other income you have).

Lump Sum Allowance (LSA)

The most you can usually take as a tax-free lump sum from all pension arrangements of £268,275 – this is known as the lump sum allowance (LSA). If you have lifetime allowance protection, the amount of tax-free cash you can take may be higher.

If you take a lump sum that goes above your LSA, you’ll need to pay Income Tax, at your marginal rate on the extra amount.

There is also a maximum tax-free amount, currently £1,073,100, called the lump sum and death benefit allowance, that applies to you and your beneficiaries in certain circumstances. This amount includes any tax-free lump sums payable at retirement and certain lump sum death benefits.

For further information about these lump sum allowances, visit the Government website here.

Remember the lump sum allowances are set by the Government and could change.