2019 Summary Funding Statement

Benefits in the UKRF’s defined benefit (DB) sections, as well as the Afterwork Credit Account, are backed by the assets of the UKRF. This Summary Funding Statement provides an update on the UKRF’s funding position as at the most recent three-yearly actuarial valuation in 2019. It also explains how the position has changed since the actuarial report in 2018 and the previous 2016 three-yearly actuarial valuation.

What is an actuarial valuation?

By law, an actuarial valuation is carried out every three years. This is a financial health check for the UKRF to assess whether the value of the UKRF’s current investments (assets) would be sufficient, without further contributions, to pay out in full the benefits already built up for all members when they become payable in the future (also called the liabilities or technical provisions). The actuarial valuation has no direct impact on the benefits which members receive from the UKRF, which continue to be paid in full as they fall due.

Taking into account market context, population trends and the UKRF’s own membership data and experience, the Trustee, with advice from the Scheme Actuary, agrees assumptions with Barclays about the likely timing and size of the cash payments from the UKRF in future. These assumptions, together with assumptions about future returns on the UKRF’s investments, are used to estimate the UKRF’s liabilities. Some of these assumptions, especially those for the future returns on investments and life expectancy, are set in a deliberately prudent manner.

The valuation compares the UKRF’s assets with these estimated liabilities. The funding level represents the proportion of the liabilities which are covered by the current assets.

If the assets are greater than the liabilities, this results in a surplus and a funding level of over 100%. In this case, no contributions are needed from Barclays in respect of the liabilities earned to date.

If the liabilities are greater than the assets, there is a deficit and the funding level is below 100%. The contributions required to eliminate a deficit have to be agreed between the Trustee and Barclays, and are set out in a Recovery Plan agreed by both parties. The deficit contributions in the Recovery Plan are in addition to the contributions towards future benefits for current members of the UKRF.

In the years between the actuarial valuations, the Scheme Actuary produces an actuarial report to explain developments each year.

What was the financial position as at the 2019 actuarial valuation of the UKRF?

The latest actuarial valuation assessed the funding position of the UKRF as at 30 September 2019. The assumptions were revised for the 2019 actuarial valuation to take into account a number of changes, the most significant of which were:

- Lower interest rates on Government bonds than as at 30 September 2016 (and 30 September 2018);

- The revised investment strategy for the UKRF which has been implemented since the 2016 actuarial valuation was completed;

- Adjustments to the life expectancy of members to reflect trends in both the UKRF and wider population; and

- Changing views on the development of inflation and therefore pension increases in future.

Taking these changes into account, the latest actuarial valuation showed that on 30 September 2019:

The value of the liabilities was £38.3bn

The UKRF’s assets were valued at £36.0bn

This means that there was a deficit of £2.3bn

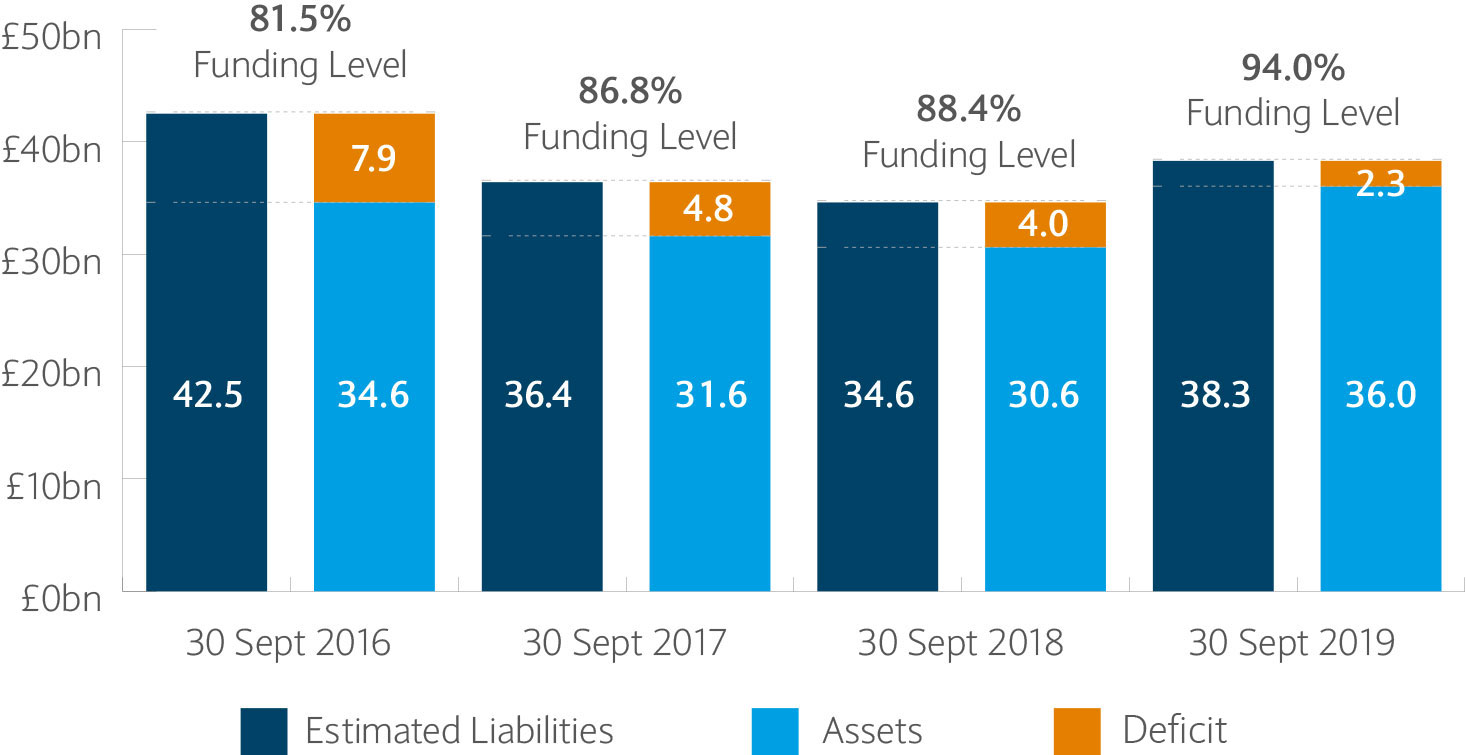

How has the position changed since the previous actuarial valuation and annual update?

The previous actuarial valuation as at 30 September 2016 revealed a deficit of £7.9bn and a funding level of 81.5%, which had decreased to £4.0bn at the time of the 30 September 2018 update.

The funding level has improved to around 94.0% as at 30 September 2019, with a deficit of £2.3bn.

How the position has changed over time

| 30 Sept 16 | 30 Sept 17 | 30 Sept 18 | 30 Sept 19 | |

|---|---|---|---|---|

| Deficit | 30 Sept 16 £7.9bn | 30 Sept 17 £4.8bn | 30 Sept 18 £4.0bn | 30 Sept 19 £2.3bn |

| Funding level | 30 Sept 16 81.5% | 30 Sept 17 86.8% | 30 Sept 18 88.4% | 30 Sept 19 94.0% |

The main reasons for the decrease in the deficit since the 2016 actuarial valuation are:

- The additional contributions paid by Barclays towards the deficit

- Returns on the UKRF’s investments being better than expected

- Increases in life expectancy being lower than anticipated, leading to changes in the expected future life expectancy of members, and

- Some members choosing to transfer their full entitlements to other pension schemes.

Additional contributions and the changes in the assumptions to reflect updated life expectancy are the main reasons for the reduction in deficit since the last annual update at 30 September 2018.

The graph below provides a summary of how the funding position of the UKRF has changed since 30 September 2016:

A summary of how the funding position of the UKRF has changed since 30 September 2016

| Year | Estimated Liabilities | Assets | Deficit |

|---|---|---|---|

| 2016 | 42.5% | 34.6% | 7.9% |

| 2017 | 36.4% | 31.6% | 4.8% |

| 2018 | 34.6% | 30.6% | 4% |

| 2019 | 38.3% | 36% | 2.3% |

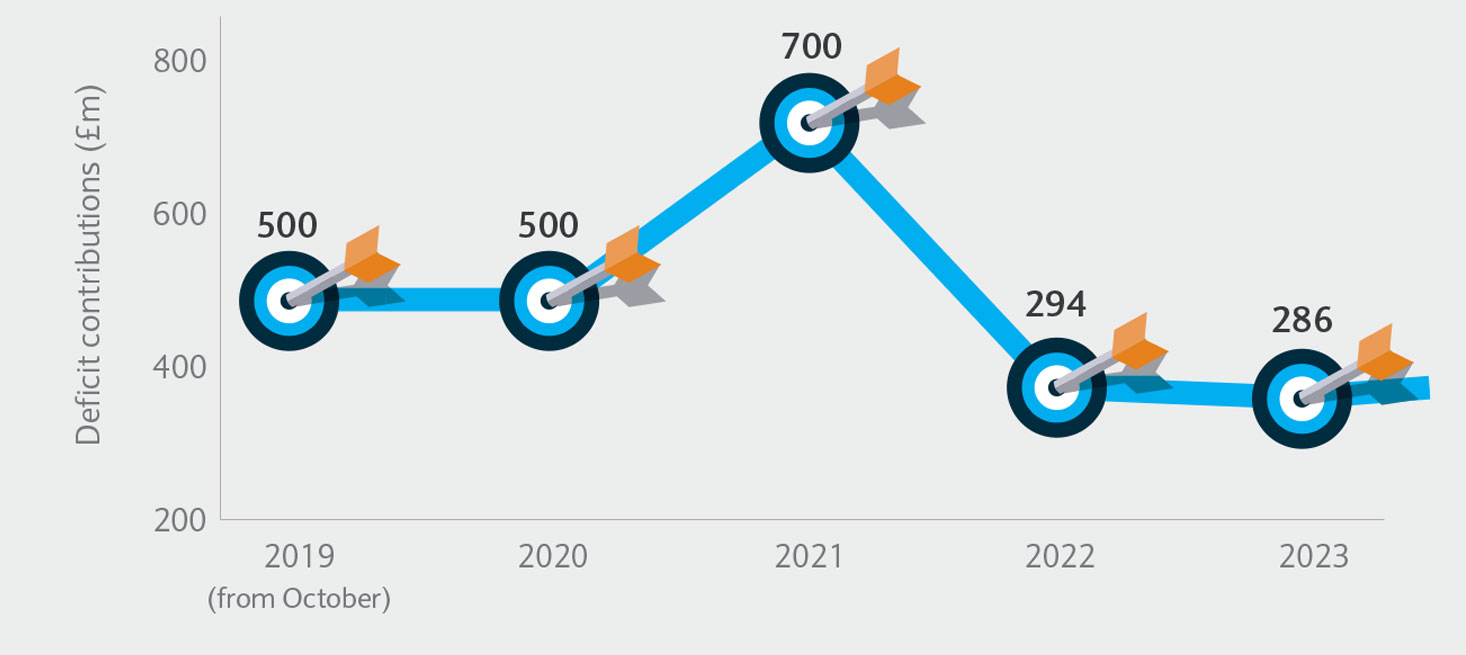

How will the deficit be met?

The Trustee has agreed a four-year Recovery Plan with Barclays to eliminate the deficit by 30 September 2023. The Recovery Plan is summarised in the graph below:

Four-year Recovery Plan

| Year | Deficit contributions |

|---|---|

| 2019 (from October) | 500 £m |

| 2020 | 500 £m |

| 2021 | 700 £m |

| 2022 | 294 £m |

| 2023 | 286 £m |

The Recovery Plan is significantly shorter, as well as lower overall, than that agreed in 2016, reflecting the material improvement in the UKRF’s financial position since 2016. The Trustee was able to agree with Barclays that almost all of the deficit will be met over the three-year period until the next valuation as at 30 September 2022.

Barclays agreed to pay a £500m contribution in December 2019 as part of the 2019 Recovery Plan, which is earlier than equivalent funding would have been received under the 2016 Recovery Plan. The UKRF used this contribution to subscribe for a £500m senior fixed rate note with restricted transfer rights, backed by UK gilts. The note was issued by a Barclays Group consolidated entity and it entitles the UKRF to twice yearly interest payments for five years, followed by full repayment of the £500m and accrued interest in cash in 2024.

Note that any Recovery Plan makes assumptions about what will happen in the future, and it is likely actual experience will be different. The Trustee will keep the Recovery Plan under review at each future actuarial valuation and, if needed, agree changes to the contributions with Barclays. The next Actuarial Valuation is expected to be as at 30 September 2022.

Further protections

The additional arrangements agreed with Barclays as part of the implementation of ring-fencing in 2016 continue to operate as before. These include:

Joint participation by the ring-fenced bank (Barclays Bank UK PLC)

Barclays Bank PLC remains the UKRF’s principal employer (main sponsor responsible for the UKRF funding).

In addition, Barclays Bank UK PLC (the ring-fenced bank), participates as an employer in the UKRF until a date in 2025. It continues to make contributions for the future service of its employees who are currently Afterwork members.

Additional security

Barclays provides a pool of assets to act as security for the funding deficit and deficit reduction contributions due to the UKRF. The Trustee would have access to this pool of assets in the event of Barclays Bank PLC not paying a deficit reduction contribution, or in the event of Barclays Bank PLC’s insolvency.

The level of security is measured regularly to reflect increases or decreases in the UKRF’s deficit and reflects the average deficit over a six month period prior to the calculation date. As at 30 September 2019, the collateral pool had a value of £4.1bn. The pool of assets could rise as high as £9bn in the unlikely event the deficit was to rise to that level in future.

Support from Barclays PLC

Additional support for Barclays Bank PLC’s obligation to make payments under the Recovery Plan will, in a situation where Barclays Bank PLC does not make a deficit reduction contribution by the specified payment date, be given by Barclays PLC, the overall group parent company, using dividends it receives (if any) from Barclays Bank UK PLC in first priority to pay the unpaid amount.

Contributions from Barclays

For the 12 months to 30 September 2019, Barclays made contributions to the UKRF of £777m.

Payments to Barclays

The Trustee can confirm that there have been no payments of any surplus made to Barclays out of the UKRF since the 2018 Summary Funding Statement.

Changes to the UKRF

The UKRF has not been modified under Section 231 of the Pensions Act 2004 nor is it subject to a direction (whether imposing a Schedule of Contributions or otherwise) from the Pensions Regulator.

The Pensions Regulator

In some circumstances, the Pensions Regulator has powers to intervene in a scheme’s funding plan. It has not used any of these powers in relation to the UKRF.

Investments

The Trustee is responsible for deciding how the DB assets of the UKRF are invested. The Trustee’s investment objectives are set out in the Statement of Investment Principles. These recognise the long-term nature of the UKRF and the Trustee’s aim to invest the assets so that the UKRF can pay members’ pension benefits when they are due. The Trustee also holds investments with the aim of reducing interest rate, inflation and currency risks, and matching investments more closely to the UKRF’s liabilities.

Investment returns 2019

The table below shows returns, from the invested DB assets, over one, three and five years compared to the UKRF liability benchmark. The liability returns show the return the UKRF needs to achieve in order to maintain the funding level.

| Total returns to 30 September 2019 | 1 year | 3 years, annualised | 5 years, annualised |

|---|---|---|---|

| Total investment returns | 1 year 21.4% | 3 years, annualised 8.3% | 5 years, annualised 11.1% |

| Liability returns | 1 year 20.8% | 3 years, annualised 4.9% | 5 years, annualised 10.4% |

These figures only show the return from invested assets. They exclude the effect of money paid out (e.g. pension payments) or money paid in (e.g. contributions from Barclays).

If the UKRF is wound up

The Trustee’s funding plan assumes that Barclays will continue in business and will continue to support the UKRF. However, if the UKRF were to be discontinued, the estimated amount that would be required, in addition to the UKRF’s assets, as at 30 September 2019, to ensure that all members’ benefits could be paid in full if secured by an insurance company, was £7.69bn (2016: £18.75bn). On this basis, the UKRF had a funding level of 82% (2016: 65%).

In the event that an employer becomes insolvent and a scheme’s assets fall significantly short of the amount needed for an insurance company to take over responsibility for paying members’ benefits in full, the Pension Protection Fund (PPF) may pay compensation to eligible members. At the current time, the funding of the UKRF is expected to be such that members would not transfer to the PPF, and could potentially receive benefits in excess of PPF compensation. Please note the PPF compensation may not fully cover members’ entitlements from the UKRF. You can find further information about the PPF at: ppf.co.uk or write to: PPF, Renaissance, 12 Dingwall Road, Croydon, Surrey CR0 2NA.

Further information

You should contact the Barclays Team at Willis Towers Watson if you have any questions about the Summary Funding Statement or to request copies of the related documents.