2018 Summary Funding Statement

Benefits in the UKRF's defined benefit (DB) sections, as well as the Afterwork Credit Account, are backed by the assets of the UKRF. This Summary Funding Statement provides an update on the UKRF's funding position for these sections. It includes details of the most recent three-yearly actuarial valuation in 2016 and the updates carried out since, and explains how the funding position has changed since the last Summary Funding Statement.

What is an actuarial valuation?

An actuarial valuation is an in depth investigation to compare the value of the UKRF's current investments (assets) against the amount of money that the Trustee estimates the UKRF needs to hold now to pay out benefits in full to all members in the future (also called the liabilities or, with reference to relevant legislation, ‘technical provisions’). The actuarial valuation has no direct impact on the benefits which members receive from the UKRF, which continue to be paid in full as they fall due. By law, the actuarial valuation is carried out at least every three years by an independent scheme actuary, appointed by the Trustee.

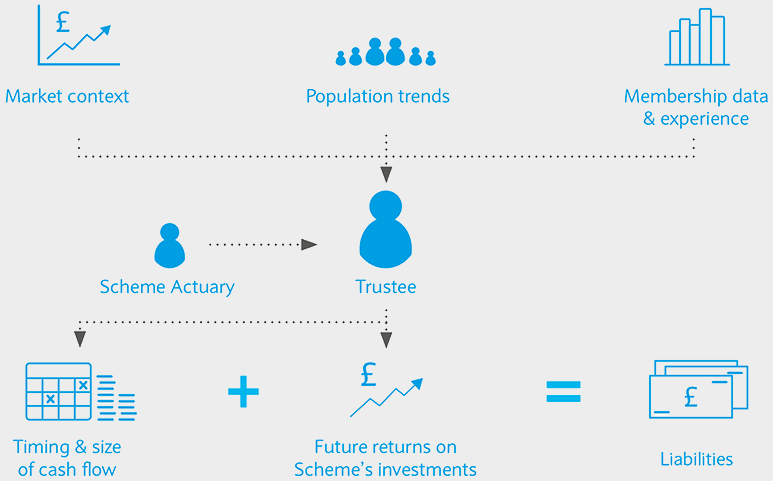

Taking into account market context, population trends and the UKRF's own membership data and experience, the Trustee, with advice from the Scheme Actuary, makes assumptions about the likely timing and size of the cash payments from the UKRF in future. These assumptions, together with assumptions about future returns on the UKRF's investments, are used to estimate the UKRF's liabilities.

The valuation compares the UKRF's assets with these estimated liabilities. The funding level represents the proportion of the liabilities which are covered by the current assets.

If the assets are greater than the liabilities, this results in a surplus and a funding level of over 100%. In this case, only contributions towards future benefits for current employed members of the UKRF may be necessary in order for the UKRF to meet its funding objectives.

If the liabilities are greater than the assets, there is a deficit and the funding level is below 100%. The contributions required to eliminate a deficit have to be agreed between the Trustee and Barclays, and are set out in a recovery plan signed by both parties. The deficit contributions in the recovery plan are in addition to the contributions towards future benefits for current members of the Scheme.

A key outcome of the valuation is therefore an agreement between the Trustee and Barclays on the future level of contributions Barclays needs to make to ensure that the UKRF meets its funding objectives. In the years between the actuarial valuations, the Scheme Actuary produces an actuarial report to explain developments each year.

What was the financial position as at the 2016 actuarial valuation of the UKRF?

Our most recent valuation was made as at 30 September 2016. Assumptions reflected scheme experience and market conditions at that date. You can see the 2016, 2017 and 2018 results in the table below.

How has the position changed since the previous actuarial valuation and the previous Summary Funding Statement?

The 2016 valuation figures were subsequently updated in the 2017 Actuarial Report, which showed that the funding level had improved from 81.5% to 86.8% by 30 September 2017.

The 2018 Actuarial Report shows that the funding level is estimated to have improved further to 88.4% (September 2018) with the deficit reducing to £4.0bn.

| The value of the liabilities was: | The UKRF's assets were valued at: | This means that there was a shortfall of: |

|---|---|---|

| £34.6bn | £30.6bn | £4.0bn |

The main factors leading to this further improvement were:

- Higher investment returns than assumed over the year

- Deficit contributions of £500mn paid by Barclays into the UKRF, in addition to the regular contributions due.

The table below shows how the funding of the UKRF has changed since 30 September 2016.

| 30 September 2018* | 30 September 2017 | 30 September 2016 | |

|---|---|---|---|

| Assets | £30.6bn | £31.6bn | £34.6bn |

| Estimated liabilities | £34.6bn | £36.4bn | £42.5bn |

| Deficit | £4.0bn | £4.8bn | £7.9bn |

| Funding level | 88.4% | 86.8% | 81.5% |

* The monetary figures have been rounded down to the nearest £0.1bn.

How will the deficit be met?

There is a ten-year recovery plan in place that the Trustee agreed with Barclays as part of the 2016 Actuarial Valuation. This aims to eliminate the £7.9bn deficit calculated at that valuation by the end of 2026 and is outlined below:

| Calendar year | Deficit Contributions (£mn) |

|---|---|

| 2016 (from October) | 75 |

| 2017 | 740 |

| 2018 | 500 |

| 2019 | 500 |

| 2020 | 500 |

| 2021 | 1,000 |

| 2022 | 1,000 |

| 2023 | 1,000 |

| 2024 | 1,000 |

| 2025 | 1,000 |

| 2026 | 1,000 |

It is important to note that any recovery plan makes assumptions about what will happen in the future, and it is likely actual experience will be different. For example, the improvements in funding since the last valuation are greater than was anticipated when the above recovery plan was agreed. The Trustee will keep the recovery plan under review at each future actuarial valuation and, if needed, agree changes to the contributions with Barclays. The next actuarial valuation is expected to be as at 30 September 2019.

Contributions from Barclays

- For the 12 months to 30 September 2018, Barclays made contributions to the UKRF of £0.8bn.

Payments to Barclays

- The Trustee can confirm that there have been no payments of any surplus made to Barclays out of the UKRF since the 2017 Summary Funding Statement.

Changes to the UKRF

- The UKRF has not been modified under Section 231 of the Pensions Act 2004 nor is it subject to a direction (whether imposing a Schedule of Contributions or otherwise) from the Pensions Regulator.

The Pensions Regulator

- In some circumstances, the Pensions Regulator has powers to intervene in a scheme's funding plan. It has not used any of these powers in relation to the UKRF.

Investments

The Trustee is responsible for deciding how the DB assets of the UKRF are invested. The Trustee's investment objectives are set out in the Statement of Investment Principles. These recognise the long-term nature of the pension scheme and the Trustee's aim to invest the assets so that the UKRF can pay members' pension benefits when they are due. The Trustee also holds investments with the aim of reducing interest rate, inflation and currency risks, and matching investments more closely to the UKRF's liabilities.

The Trustee has a long-term plan to reduce investment risk as part of the strategy to become largely ‘self-sufficient’ by 2026. ‘Self-sufficiency’ is where the UKRF is funded and the assets are invested in such a way that, once achieved, it is less likely a deficit will arise and so the UKRF is expected to have a much lower reliance on Barclays for any future shortfall. This has involved a significant programme of de-risking whereby growth assets, such as equities, are switched into assets which more closely match the UKRF's liabilities, like index-linked gilts. The first stage of de-risking was carried out in 2017, with the improved funding position of the UKRF allowing further de-risking to be carried out in 2018. The Trustee has agreed with Barclays to progress with further re-structuring of the investments over the next few years to even more closely align the investments with the UKRF's liabilities.

Investment returns 2018

The table below shows returns, from the invested DB assets, over one, three and five years compared to the UKRF liability benchmark. The liability returns show us the return the UKRF needs to achieve in order to maintain the funding level.

| Total returns to 30 September 2018 |

1 year | 3 years, annualised | 5 years, annualised |

|---|---|---|---|

| Total investment returns | 3.6% | 8.9% | 9.2% |

| Liability returns | 2.8% | 9.2% | 10.6% |

These figures only show the return from invested assets. They exclude the effect of money paid out (e.g. pension payments) or money paid in (e.g. contributions from Barclays).

If the UKRF is wound up

The Trustee's funding plan assumes that Barclays will continue in business and will continue to support the UKRF. However, if the UKRF were to be discontinued, the estimated amount that would have been required, in addition to the UKRF's assets, as at 30 September 2016, to ensure that all members' benefits could be paid in full if secured by an insurance company, was £18.75bn. On this basis, the UKRF had a funding level of 65%.

In the event that an employer becomes insolvent and a scheme's assets fall significantly short of the amount needed for an insurance company to take over responsibility for paying members' benefits in full, the Pension Protection Fund (PPF) may pay compensation to eligible members. Please note the PPF compensation may not fully cover members' entitlements from the UKRF. You can find further information about the PPF at: ppf.co.uk or write to:

PPF,

Renaissance,

12 Dingwall Road,

Croydon,

Surrey

CR0 2NA.

Further information?

You should contact the Barclays Team at Willis Towers Watson if you have any questions about the Summary Funding Statement or to request copies of the related documents.