Climate change reporting and the UKRF

The Trustee of the Barclays Bank UK Retirement Fund (the UKRF) takes overall responsibility for the security of members’ benefits. The Trustee sees climate change as a key risk. However, the global response to climate change also presents an opportunity for the UKRF to make sound investments, which could provide good financial returns for UKRF members whilst also supporting efforts to address the risks of climate change.

The Trustee of the UKRF has produced its third formal climate report, known as a

TCFD statement

The Task Force on Climate-Related Financial Disclosures was created by the Financial Stability Board, which is an international body that monitors and makes recommendations about the global financial system.

Its purpose is to help organisations to disclose climate-related risks and opportunities. It is structured around four key pillars: Governance, Strategy, Risk Management and Metrics & Targets.

, covering the year from 1 October 2023 to 30 September 2024, linked here. The report sets out the progress made over the year in relation to the Trustee’s ambitions to reduce emissions.

The Trustee’s climate ambitions

The Trustee is continuing to work with its advisors and investment managers to reduce the impact of climate change and manage the risks it poses to the UKRF. For example, the Trustee is aiming to achieve net zero Achieving net zero means that greenhouse gas emissions put into the atmosphere are equal to those taken out. greenhouse gas emissions Greenhouse gas emissions are emissions that trap heat in the Earth’s atmosphere. These emissions are released through a variety of processes, such as the burning of fossil fuels for energy. from the UKRF’s assets by 2050 and to halve its emissions intensity by 2030 as shown below.

These climate ambitions are regularly reviewed.

2030

50% reduction in greenhouse gas emissions intensity

In line with the goals of the Paris Agreement, the Trustee aims to reduce greenhouse gas emissions from the UKRF's portfolio of investments by at least 50% by 2030.

2050

Net zero greenhouse gas emissions

In line with the goals of the Paris Agreement, the Trustee aims to reach net zero greenhouse gas emissions from the UKRF’s portfolio of investments by 2050.

Ongoing

Improved climate data coverage will allow the Trustee to make informed decisions

Improving the availability and reliability of data results in better data coverage of the Trustee’s assets. This allows the Trustee to make more informed decisions around managing climate risks.

More information about the Trustee’s climate-related ambitions and the different types of carbon emissions is available at Committed to Net Zero and in the following newsroom article on carbon emissions.

How the Trustee is turning its ambitions into action

The Trustee’s plan to reach its climate-related ambitions is structured around four areas reflecting the TCFD framework. The actions currently being taken by the Trustee include:

Governance

The Trustee is managing risks and opportunities from climate change by:

- Integrating climate change within the UKRF’s risk management framework.

- Considering climate when setting strategies, selecting investment managers and monitoring environmental, social and governance (ESG) activities.

- Actively managing investments.

- Receiving training to keep up to date on climate change.

Risk management

The Trustee is managing climate risks by:

- Joining relevant organisations and inputting on climate discussions.

- Using influence to push for the transition to net zero through targeted engagement.

- Settings goals and monitoring advisors and investment managers.

- Exploring low-carbon alternative investment options.

Strategy

The Trustee has developed an action plan for climate change by:

- Assessing the impact of climate change on the UKRF’s funding and investment strategy.

- Integrating ESG considerations and climate into the UKRF’s investment processes.

- Using models and analysis to see how different climate situations might affect the UKRF’s investments, liabilities, and sponsor covenant over time. This helps the Trustee spot key areas to focus on and decide on possible actions to take.

Metrics and targets

The Trustee is measuring and monitoring the impact of climate change by:

- Working with investment managers to improve data quality and coverage.

- Selecting metrics to monitor progress against.

- Identifying actions to take to achieve its climate ambitions like engaging with investment managers and considering alternative investment options.

The Trustee’s climate metrics

The Trustee uses the following four climate metrics to measure its progress managing climate risks. More detail can be found in the full TCFD report.

Metric |

|

|---|---|

1 - Absolute Emissions |

Total absolute greenhouse gas emissions that are attributable to the UKRF’s assets. |

2 - Emissions intensity |

The amount of greenhouse gas emissions released for each £1 million invested of the UKRF’s assets. |

3 – Data quality |

The proportion of the UKRF’s assets for which emissions data is available to measure absolute emissions and emissions intensity. |

4 – Portfolio alignment |

The proportion of the UKRF assets invested in companies which have a Science Based Targets initiative ( SBTi Companies that have an SBTi approved pathway to reduce greenhouse gas emissions have set science-based emissions reduction targets to limit global warming to 1.5°C or well below 2°C above pre-industrial levels. )* approved pathway to reduce their greenhouse gas emissions. |

Tracking progress against the Trustee’s ambitions

A key part of the Trustee’s strategy is to monitor progress as it takes steps to reduce the impact of climate change and manage climate-related risks. When measuring progress against its net zero ambitions, the Trustee considers changes to the UKRF’s absolute emissions and

emissions intensity

Emissions intensity has been measured for the UKRF based on 21% of DB assets and 65% of DC assets.

The Trustee will seek to include a greater proportion of assets in its emissions intensity baselines in future years as data quality and coverage improves.

since 31 December 2020 (the baseline).

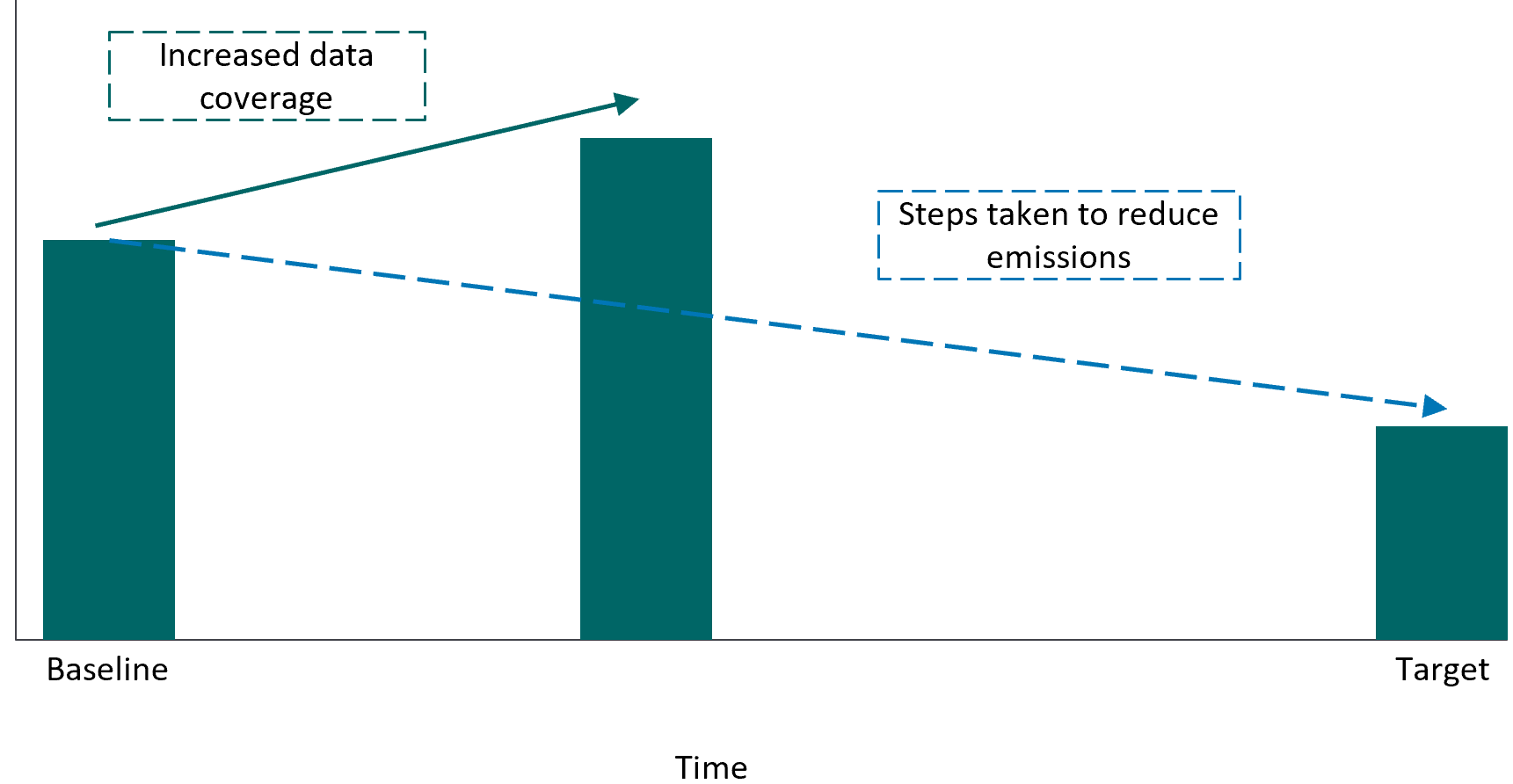

The reporting of greenhouse gas emissions is a developing area. Whilst there remain challenges around the availability and quality of emissions data, this has significantly improved in recent years. As a result, many trustees, businesses and asset owners are seeing their trend in emissions data impacted by more data now being available, which can mask the effect of steps taken to mitigate climate change impacts. A simplified example of this can be seen in the graphic below.

Illustrative emissions intensity trend

Emissions intensity

(tonnes CO2/£m invested)

Note that changes in emissions intensity may also be driven by a number of additional factors, including asset allocation and the market valuation of assets.

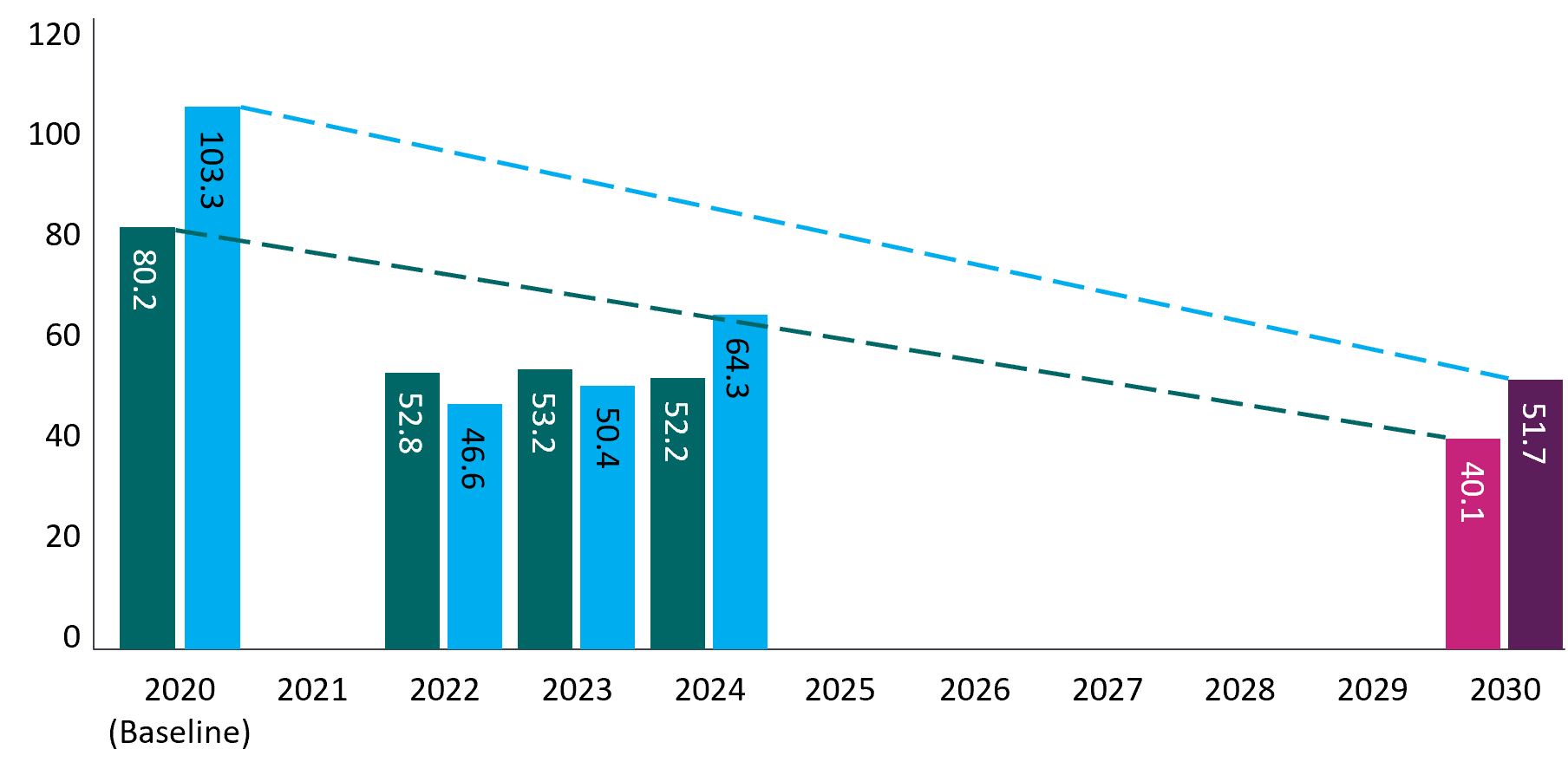

The chart below sets out the UKRF’s performance against its emissions intensity ambitions between 2020 and 2024.

Journey to the Trustee’s 2030 ambitions (DB & DC)

Emissions intensity

(tonnes CO2/£m invested)

- DB Emissions intensity

-

DB 2030 ambition

(50% reduction against baseline)

- DC Emissions intensity

-

DC 2030 ambition

(50% reduction against baseline)

Journey to the Trustee’s 2030 ambitions (DB)

34.9%

DB reduction from 2020 - 2024

Journey to the Trustee’s 2030 ambitions (DC)

37.7%

DC reduction from 2020 - 2024

Additional data was available for the UKRF in the year to 30 September 2024, driving an overall increase in absolute emissions for the UKRF.

For the DB arrangements A defined benefit pension scheme is a type of pension scheme in which an employer promises a specified schedule of pension payments during retirement based on the employee's earnings history, tenure of service and age. , the additional data related to assets with a similar emissions intensity i.e. released similar levels of greenhouse gas emissions for each £1m invested to the assets included last year. As a result, absolute emissions increased, whereas emissions intensity reduced slightly (see chart above). For the DC arrangements, assets with data newly available this year were more carbon intensive than the assets included last year. Therefore, emissions intensity increased during the year (see chart above).

Whilst this may appear negative for the Trustee in achieving its ambitions, increasing data availability is positive for understanding the UKRF’s exposure to climate risk and making informed decisions around the transition to net zero. Despite the increase, the Trustee remains on track against its 2030 interim ambitions.

More information on the metrics data and supporting details can be found in the full TCFD report.

The Trustee’s focus on continual improvement

The Trustee is focused on continually improving its reporting and how it uses climate information to inform its investment and funding strategy. Ongoing work includes:

- Working with its investment managers and advisors to enhance data and reporting as data availability, methodologies and analytical tools develop. This will mean the Trustee is better able to track its progress to lower greenhouse gas emissions and make more informed decisions.

- Continuing to widen the scope of the Trustee’s ambition to include emissions of more of the UKRF’s assets.

- Reviewing and evolving scenario analysis in line with the industry.

- Further integrating climate data into investment decision making.

- Increasing engagement and setting higher expectations for investment managers and the companies in which the UKRF invests to reduce emissions, and where appropriate, encouraging further action.

To find out more about the Trustee’s approach to climate-related risks and opportunities, view the full TCFD report.