The Barclays Bank UK Retirement Fund

About this Statement of Investment Principles

This is the Statement of Investment Principles (SIP) for the Barclays Bank UK Retirement Fund (the Fund). The purpose of the SIP is to detail the policies that control how the Fund invests. It contains the investment principles that govern the strategic investment decisions in relation to the Defined Benefit (DB) and Defined Contribution (DC) arrangements of the Fund. The investment principles are set by the Trustee, and reflect the Trustee’s approach to investment objectives, governance, and risk, including responsible investment.

From 1 July 2025 (the sectionalisation date), the Fund has been split into two Sections, operating independently of each other under the same legal trust, with the same Trustee and managed on a common basis:

- Barclays UK Section; and

- Barclays Bank Section.

Within the Barclays Bank Section, there are various closed arrangements which reflect the different benefit structures of ceding banks and other companies incorporated into Barclays. The closed DB arrangements in the Barclays Bank Section are managed on a combined basis with one actuarial valuation and one DB investment strategy to meet their combined needs for funding and investment. The closed DC arrangements are operated in accordance with their original rules. Hereafter in this SIP, “Section” will refer to the Barclays UK Section and the Barclays Bank Section, whereas “section” refers to the various closed historic arrangements as set out above. Closed sections of the Fund contains a table listing all the closed sections of the Fund.

Members should check that they are a member of one of these sections before reading this SIP.

For members with DC savings, this document should be read in conjunction with other documents regarding the investment process of the DC arrangements; these can be found on the member pages of ePA.

Where we have used defined terms, these appear in blue the first time they are used and are explained in the Glossary.

Preparation of the SIP

This SIP has been agreed by the Directors of the Trustee of the Fund and is written in accordance with relevant UK legislation.

As the Fund is split into the two Sections as described above, the Trustee prepared the SIP after consultation with Barclays Bank PLC as principal employer to the Barclays Bank Section for matters that are relevant to them, and Barclays Bank UK PLC as principal employer to the Barclays UK Section for matters that are relevant to them. Parties have considered appropriate written advice where required by UK legislation.

The Trustee will also consult Barclays Bank PLC and Barclays Bank UK PLC in respect of their respective Sections and again consider appropriate written advice from the investment consultant as required by law before this SIP is revised.

The SIP is also reviewed by the Scheme Actuary, the investment consultant, and legal advisers.

This SIP will be reviewed following any material changes to the investment strategy of the Fund and no less frequently than every three years.

The Trustee publishes annual Implementation Statements as required by law, one for the DB investments and one for the DC investments, detailing how the investment policies set out in this SIP have been implemented and reasons for any changes to these policies.

Trustee responsibilities

The Trustee’s fiduciary duty is to act in the beneficiaries’ best interests.

In accordance with relevant UK legislation, the Trustee will set general investment policy for both the DB and DC investments of the Fund (and has discretion over the design of the DC investment options offered to members), but will delegate the responsibility for selection of specific investments to appointed investment managers, which may include an insurance company or companies.

The Trustee has delegated certain investment-related responsibilities to its Funding and Investment Committee (FIC) and Defined Contribution Committee (DCC) which facilitate, oversee and monitor the implementation of the Trustee’s investment strategies, including Responsible Investment. The FIC and DCC regularly review investment performance and monitors compliance with regulatory requirements.

The FIC monitors the DB funding position and risk metrics and recommends actions to the Trustee Board within agreed parameters. It also monitors compliance with regulatory requirements.

The DCC monitors the DC default and self-select ranges and makes recommendations to the Trustee Board where required.

The Trustee has delegated many of its day-to-day scheme management and governance responsibilities and powers to the UKRF Executive Team.

The Trustee has delegated the detailed implementation, management and monitoring of investment policy to Oak Pension Asset Management Ltd (OPAM), which operates under an Investment Advisory and Management Agreement (IAMA) for each Section from the Trustee, within parameters approved by the Trustee. These include the appointment, instruction, monitoring and removal of individual investment managers and other investment-related providers.

OPAM is responsible for ensuring that any investments made are satisfactory as required by relevant UK legislation.

For the avoidance of doubt, the Trustee Board retains responsibility for the over-arching investment strategies and key investment documents, including this SIP.

OPAM has been provided with a copy of this SIP.

Responsible investment

Responsible investment is an approach that integrates long-term investment, environmental, social and governance (ESG) factors and effective stewardship into the investment processes and decision making, to better manage risk and generate sustainable returns.

The Trustee believes that there is compelling evidence that sustainable business practices lead to better risk-adjusted returns and outcomes in the long-term, and the Trustee therefore aims to fully incorporate assessment of these practices within its investment processes.

The Fund has a stand-alone Responsible Investment policy, available on its website1 which describes the Trustee’s approach to ESG factors and related matters in respect of both Sections. It is based on the guiding principles of integration, ownership, disclosure, good practice, collaboration and communication with members and other stakeholders. The Trustee considers non-financial matters, including views and matters that are proactively raised by members as part of its overall decision making and setting of investment strategy. The Trustee sees climate change as a key systemic financial risk and hence a priority for stewardship activity, together with associated ESG issues. The Trustee also recognises nature, including biodiversity loss as a potentially systemic financial risk. The Trustee recognises the important role of stewardship in mitigating climate and nature related risks.

The Fund additionally has a standalone Stewardship policy which applies to all investments across both Sections. The Stewardship policy describes the Trustee’s approach to stewardship generally, including its policy on voting and engagement and process for overseeing parties that carry out stewardship and engagement activity, including exercise of voting rights, on its behalf.

Stewardship is carried out by the Trustee via oversight and challenge of external service providers which enables the Fund to operate as active stewards of the underlying assets in which the Fund invests. The Trustee has appointed OPAM to act in a fiduciary capacity in relation to the Fund. The Trustee has appointed EOS at Federated Hermes Limited (EOS) as a dedicated specialist engagement provider, for the Fund’s DB assets, to maximise Trustee influence as an active owner.

In principle, the Trustee believes that proxy voting activity should not be conducted in isolation but rather as part of a wider engagement strategy. Rather than prescribing specific actions, EOS and the Fund’s external managers are afforded a measure of discretion and flexibility.

EOS will identify companies in which the Fund is invested and conduct a programme of engagement where EOS considers it both desirable and feasible to influence change, working with other stakeholders as appropriate. Areas that may prompt EOS to identify engagement opportunities on behalf of the Trustee include corporate governance and management of environment, social and strategy issues with a view to improving long-term outcomes. EOS will provide the Trustee with the opportunity to endorse or sign on to responses to consultations where practical.

The Trustee will regularly monitor the effectiveness of EOS activities and, where appropriate, will consider how engagement could inform investment decisions. The Trustee monitors material stewardship activity, including where agents take different voting actions at the same company. OPAM is responsible for monitoring EOS to ensure that engagement activities and outcomes are aligned with the Trustee’s climate-related objectives.

For the DC arrangements, the Trustee has delegated the day-to-day stewardship activities, including voting and engagement, to its Investment Managers. It monitors voting and engagement against the guiding principles outlined in its Responsible Investment policy, a copy of which has been provided to the investment managers.

The Trustee expects its investment managers to adhere to the principles within the UK Stewardship Code. The Trustee encourages its investment managers to apply the principles of the Code to both UK and overseas holdings where possible. The primary mechanisms for the application of effective stewardship for these holdings are engagement with investee companies and the exercise of voting rights. The Trustee expects its external equity investment managers to pursue both these mechanisms while being mindful of context.

The Trustee provides an environmentally responsible investment option, the Sustainable Equity Fund, which members can choose as part of the self-select fund range. The Trustee has integrated ESG factors into the default investment strategies of the Fund’s DC arrangements: the UKRF Lifestyle Fund(s). The Trustee will continue to monitor and review its approach in this area.

The Trustee recognises that stewardship and active ownership principles apply across all the Fund’s investments. In selecting investment managers, the managers’ policy on and approach to stewardship is an important factor in the process, with expectations tailored according to the different asset classes and the investment style of each manager.

Asset manager policy

The terms of the long-term relationship between the Trustee and OPAM, which continues until terminated, are set out in separate Investment Advisory and Management Agreements (IAMA), one for each Section. These document the Trustee’s expectations of OPAM, alongside the Investment Guidelines OPAM are required to operate under.

The Investment Guidelines reflect the policies set out in this document (the SIP), the Trustee’s Pension Risk Management Frameworks (the PRMFs) for each Section and the Responsible Investment policy. The Investment Guidelines are updated following any change to one of these documents, ensuring OPAM always invest in line with the Trustee’s policies.

The Trustee requires OPAM to appoint investment managers with an expectation of a long-term partnership, which continues until terminated and encourages active ownership of the Fund’s assets. OPAM ensures that the investment managers take into account all financially material considerations over the appropriate time horizon of the investments when selecting, retaining and realising investments. When assessing a manager’s performance, the focus is on longer-term outcomes, and the Trustee would not expect to terminate a manager’s appointment based purely on short-term performance. However, a manager’s appointment could be terminated within a shorter timeframe due to other factors such as a significant change in business structure or the investment team.

Managers are paid an ad valorem fee, in line with normal market practice, for a given scope of services which includes consideration of long-term factors and engagement.

For some asset classes, the Trustee does not expect OPAM to make decisions based on long-term performance. These may include investments that provide risk reduction through diversification or through hedging, consistent with the Trustee’s strategic asset allocation.

OPAM maintains oversight of third-party investment managers on behalf of the Trustee. At OPAM's discretion, if a third-party investment manager can no longer be expected to invest in line with the policies of the Trustee, OPAM will find a suitable replacement. Investment performance is assessed over a medium- to longer-term timeframe, subject to a minimum of three years.

The Trustee monitors the performance of OPAM by using relevant comparators and meeting on a regular basis to discuss and review the investment activity carried out on their behalf. It is the responsibility of the Trustee to satisfy itself that OPAM continues to carry out its work competently, provides value to the Trustee, and that it has appropriate knowledge and experience to manage the investments of the Fund.

The Trustee reviews the costs incurred in managing the Fund’s assets annually. In addition, OPAM reviews the costs associated with portfolio turnover. In assessing the appropriateness of portfolio turnover costs at an individual manager level, OPAM will have regard to the actual portfolio turnover and how this compares with the expected turnover range for that mandate.

Other investment policies

Use of derivatives

The Trustee may use a variety of derivatives in order to manage the Fund efficiently.

Employer related investments

The Trustee has a general policy of no direct employer related investments in Barclays Bank PLC, Barclays Bank UK PLC or associated companies. However, the Trustee has accepted an indirect exposure to securities in Barclays Bank PLC or Barclays Bank UK PLC through holdings in equity or bond index-tracking funds or through derivatives on equity or bond indices. Some indirect investment may also occur via independently managed pooled investment funds.

The Trustee adheres to the statutory limitation of 5% of total assets in such employer related investments both at an overall level and by each Section. This limit includes assets held in independently managed pooled investment funds.

The Trustee reviews any such assets regularly and takes appropriate action where necessary.

Back to top

Defined Benefit (DB) sections

Please note that the following information relates to the DB sections of the Fund.

Investment objectives

The Trustee’s primary objective is to meet the Fund’s obligation to pay benefits as they fall due, with a high degree of certainty and at an economical cost, by building a low-risk, diversified portfolio of assets, derivatives and hedges that will in aggregate provide a close cashflow match to the liabilities and therefore reduce reliance on the principal and participating employers of the relevant Section to a practical minimum.

Overarching investment policy

The Trustee’s policy is to seek to achieve its primary objective through investing in a diverse range of assets for each Section that are expected to deliver a sufficient investment return which should enable the Fund to meet its pension obligations. The range of asset classes that the Fund invests in, either through pooled investment funds or segregated arrangements, broadly includes the following:

For the Barclays Bank Section:

- Bonds and other debt instruments

- Private equity and infrastructure

- Property and land

- Insurance linked assets

- Commodities

- Hedge funds

- Currencies

- Cash.

For the Barclays UK Section:

- Listed and traded equity and other equity instruments

- Bonds and other debt instruments

- Currencies

- Cash.

The Trustee will vary the Fund’s allocation to different assets within both Sections over time, with a view to reducing risk and volatility of assets relative to liabilities where appropriate, to help ensure the Fund meets its primary objective of being able to pay benefit obligations. To achieve this, the Fund will target more contractual sources of return from credit assets, and the Trustee will monitor the funding level of the Fund compared to its long-term funding targets and take appropriate action if this varies by more than a margin set over or under expectations.

Expected returns on investments

The Trustee has considered the investment return (net of fees) and risk that each asset class is expected to provide for both Sections. The Fund invests in a range of assets which are broadly split between:

- those that are expected to deliver a higher level of return but have a higher level of risk relative to the benefits that are expected to be paid (often referred to as “return-seeking assets”); and

- those that are expected to deliver a lower level of return but whose value moves more closely in line with the benefits that are expected to be paid (often referred to as “liability-matching assets”).

The day-to-day selection of asset classes and managers is delegated to OPAM, who is tasked with achieving a level of expected return (and risk) that is aligned with the Trustee’s ambition of achieving a 110% funding level on a low-risk basis (the Long Term Objective, LTO) by 30 September 2031 for both Sections.

Risk management

In setting investment strategy, the Trustee recognises that the Fund is exposed to a number of different risks which vary in their nature and magnitude. These risks include (but are not limited to) interest rate risk, inflation risk, currency risk, longevity risk, counterparty risk, credit risk, market risk, climate-related risk, liquidity risk, covenant risk and manager risk. In general, the Trustee aims to manage these risks through the following actions:

- Diversification of investments across a broad range of asset classes and investment managers;

- Hedging of certain types of risks (e.g. interest rate risk, inflation risk and longevity risk) through holding hedging assets and the use of derivatives;

- Appropriate monitoring of each Sections’ assets relative to the liabilities that need to be met;

- Appropriate monitoring and maintenance of each Sections’ collateral position with respect to its hedging portfolios;

- Appropriate internal investment controls and processes used by OPAM and the investment managers; and

- Regular monitoring of the strength of the sponsor covenant provided by Barclays Bank PLC and Barclays Bank UK PLC in respect of the Sections for which they act as the Principal Employer.

The Trustee aims to control the level of investment risk through setting limits for common quantitative risk measures such as Value-at-Risk and Funding Ratio-at-Risk. The other specific risk goals set by the Trustee for both Sections are as follows:

- The Trustee aims to achieve a funding level hedge against movements in interest rates and inflation, up to a maximum of 110% of the LTO funding level that is consistent with the Trustee’s funding ambition. The Trustee also aims to ensure that at least 85% of each Sections’ assets are sterling denominated after allowing for currency hedging.

- The Trustee will ensure that each Section invests in a diversified global portfolio of high-quality credit and contractual cashflow assets that yield an acceptable premium over gilts.

- The Trustee will monitor the probability of each Section being in a funding deficit over a given period.

- The Trustee will maintain an appropriate amount of liquidity for each Section to cover all projected outflows.

- The Trustee aims to maintain a positive collateral buffer for each Section to withstand a prudent level of market volatility that could affect its hedging assets and disrupt its liability hedging portfolios. The Trustee regularly monitors the level of available and required collateral to support its liability hedging portfolios.

- Climate change is considered a material systemic financial risk for the Fund which could impact the Fund’s investments. In the interests of members and to ensure alignment with the goals of the Paris Agreement, across the Fund the Trustee aims to halve levels of greenhouse gas emissions by 2030 and to be net zero carbon by 2050 or sooner. The Trustee will continue to develop climate change risk management goals in support of its ambition, and to integrate and manage the consideration of these issues within the Fund. This work will be supported by the Institutional Investor Group on Climate Change (IIGCC) Net Zero Investment Framework and will incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The following additional risk goal applies to the Barclays Bank Section:

- The Trustee considers longevity risk (i.e. members living longer than anticipated) as material for the Barclays Bank Section, has longevity hedges in place and, where appropriate, will consider extending longevity hedging options to further mitigate this risk. The Trustee will also incorporate an allowance for longevity risk in its regular risk reporting.

The following additional risk goal applies to the Barclays UK Section:

- The majority of the benefits by value are paid as lump sums at retirement and the uncertainty around their timing means that this Section potentially requires a higher level of liquidity. As a result of this, the current asset allocation does not include any illiquid assets.

Back to top

Defined Contribution (DC) sections

Please note that the same DC arrangements are in place for all members of both Sections and the following information relates to the DC assets held within both Sections of the Fund.

Investment objectives

The Trustee’s primary objective is to make available at a reasonable cost, a number of investment options that provide members with access to a range of different asset classes that differ in their level of investment risk and return objectives. The aims and objectives in relation to the default arrangements, the use of illiquid assets and other investments held are intended to ensure that those assets are invested in the best interests of the group of persons consisting of relevant members and relevant beneficiaries.

Overarching investment policy

The Trustee’s policy when setting or reviewing DC investment strategy is to consider how suitable the proposed investments are for members of the Fund and the need for the diversification of investments. The Fund provides a number of investment fund options through different investment managers. Pooled investment funds may be used to gain access to different asset classes.

To meet members’ needs, the Trustee has decided to make available to members of both Sections, two Lifestyle Funds which are the default investment strategies for the Fund:

- The UKRF Lifestyle Fund; and

- The UKRF Lifestyle (Closed) Fund.

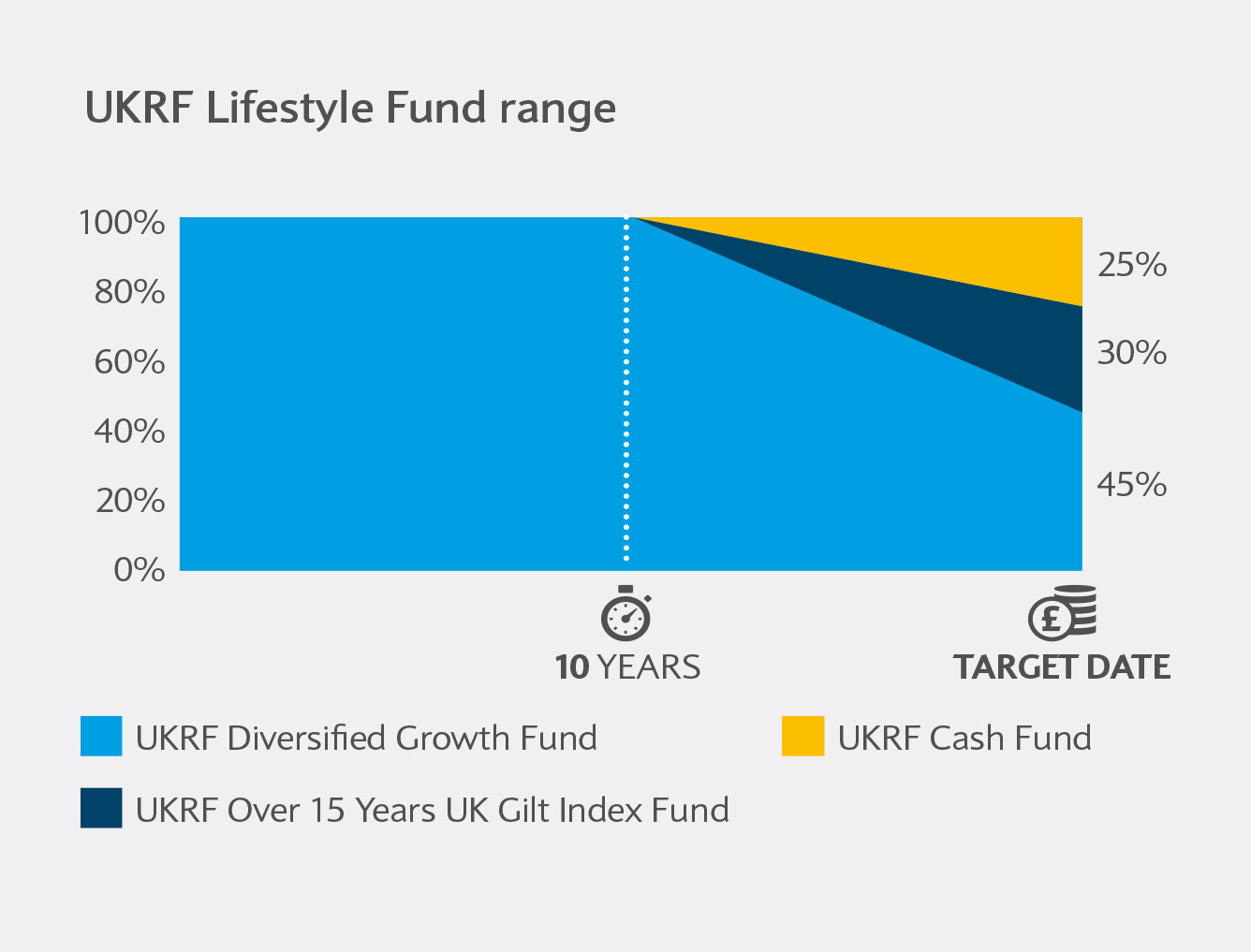

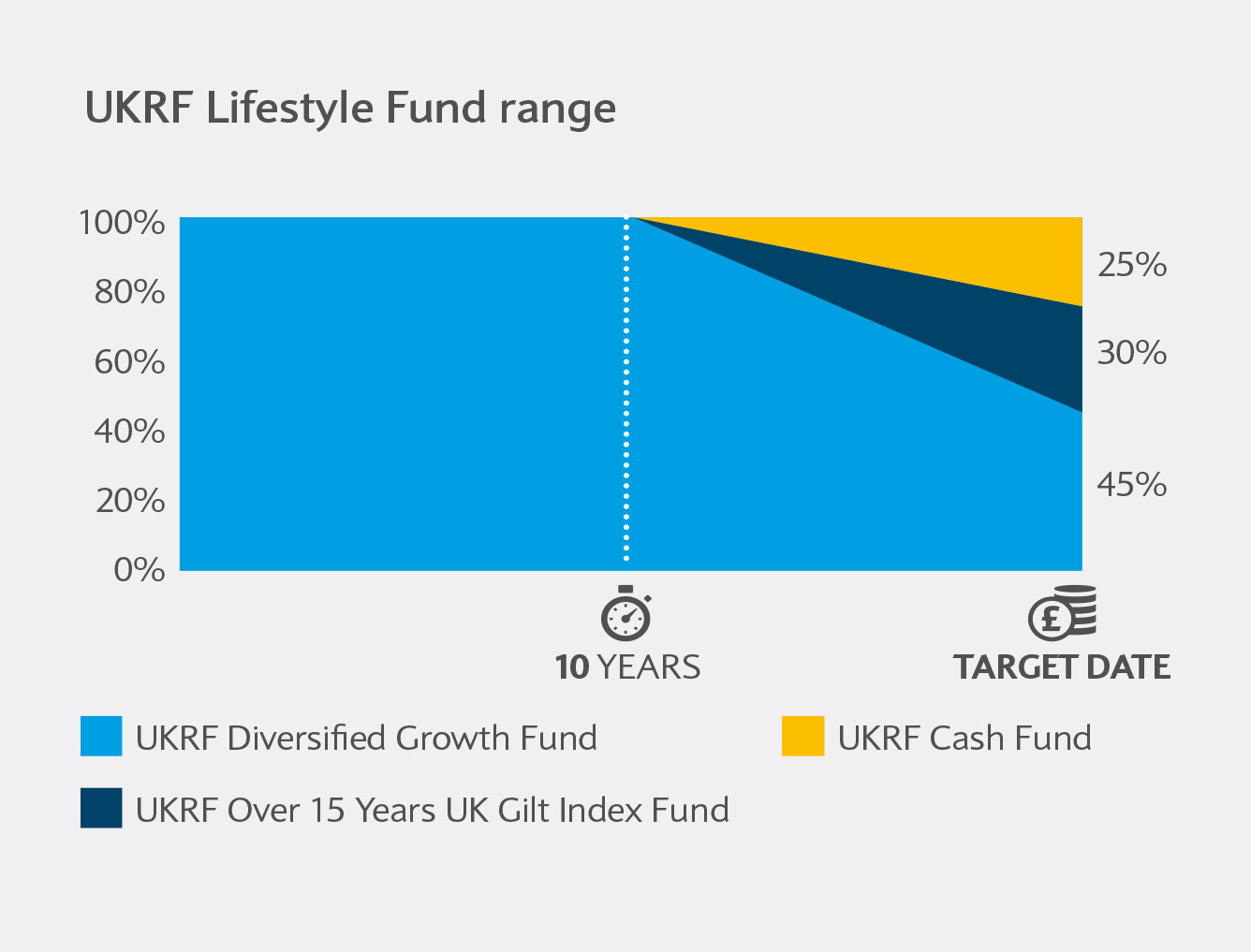

The investment objective of the Lifestyle Funds is to generate capital growth over the long term and provide increasing levels of capital and retirement income protection as a member approaches their target retirement date. Investments in the Lifestyle Funds are made primarily through exposure to the UKRF Diversified Growth Fund (more information regarding which is detailed below) and index-tracking funds. This approach means the Lifestyle Funds have a low turnover of investments, and also means they are widely diversified.

These Lifestyle Funds together with a number of additional investment options offered to members help mitigate the investment risks that members face. A full list of the range of funds offered is included in UKRF DC investment options, and more detail on the Lifestyle Funds can be found in UKRF DC default investment strategy. The Trustee will review the range of options available to members at appropriate intervals.

Members of both Sections may also have investments in legacy with profit policies. These are invested outside of the Fund and therefore the Trustee does not set the investment strategy for the funds provided through these policies. Further details on these policies can be found in With profit policies.

Expected returns on investments

The UKRF Lifestyle Fund is made up of a range of funds including the UKRF Diversified Growth Fund. The UKRF Diversified Growth Fund manager allocates to a range of asset classes, including derivatives, with the investment objective of outperforming short-term cash (i.e. deposit) rates by 4.5% pa over the long term, albeit realised returns are market-driven and could significantly differ from the objective over the short to medium term. The UKRF Diversified Growth Fund is used in the growth phase of the UKRF Lifestyle Fund and progressively switches into assets with a lower expected return in the 10 years prior to retirement.

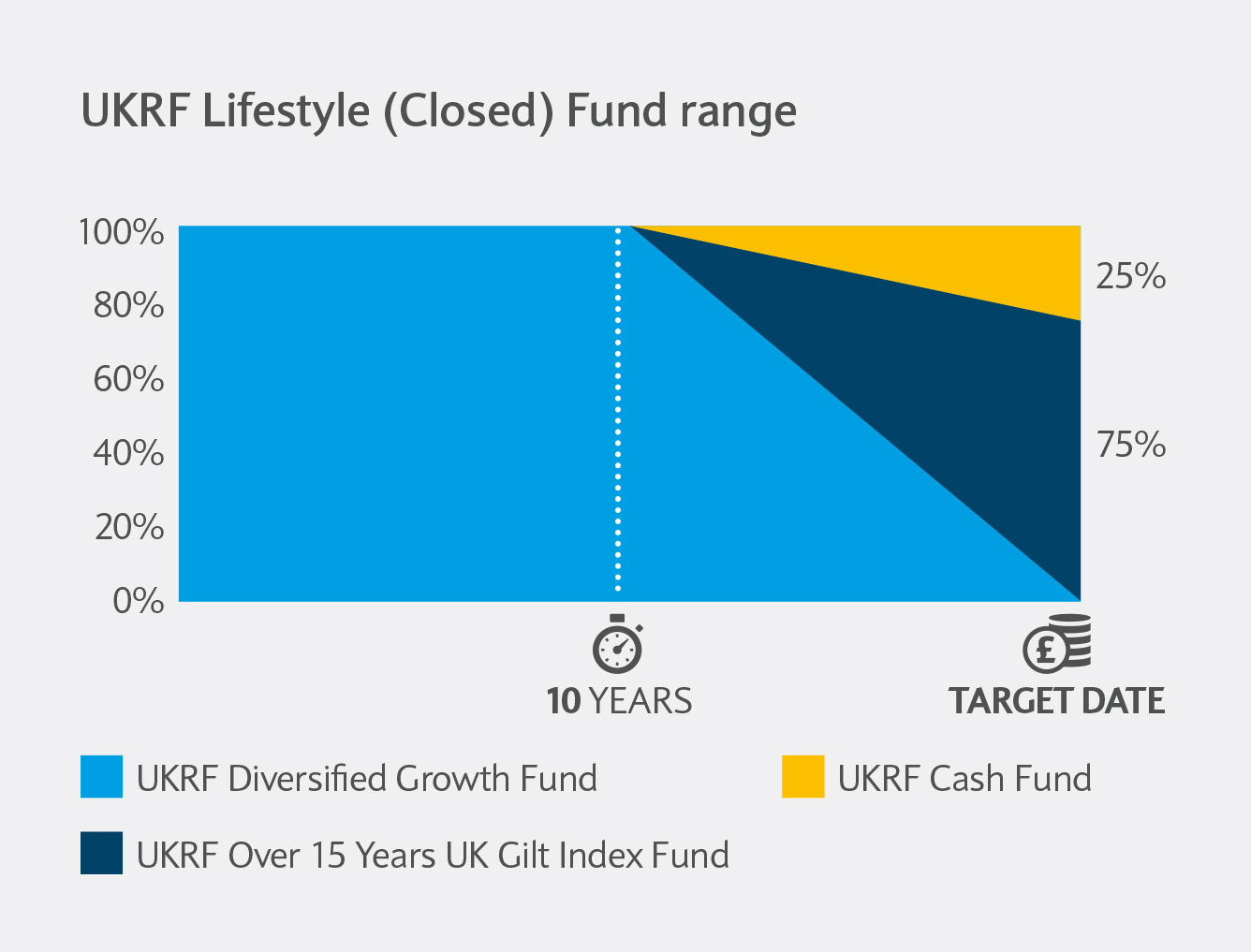

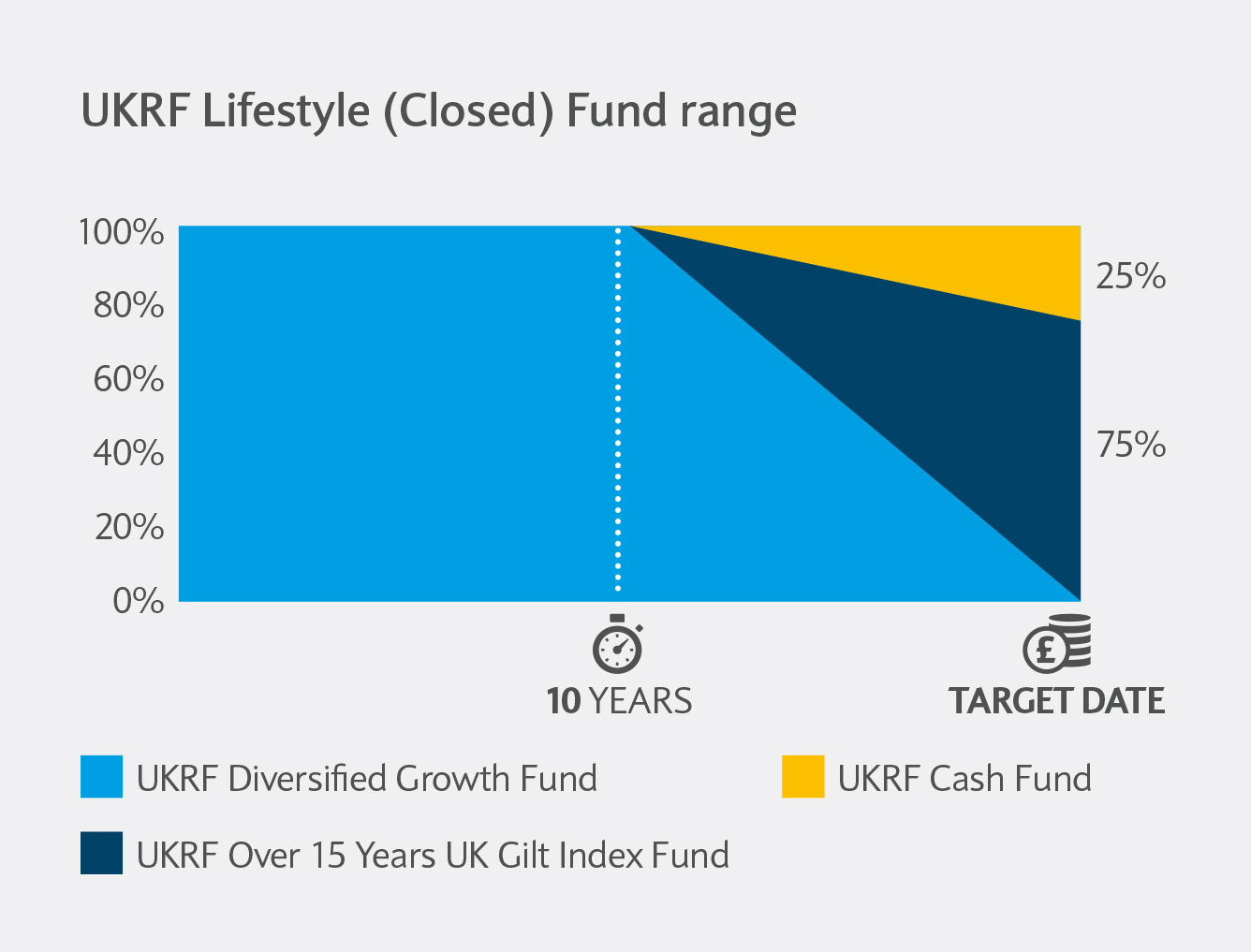

The UKRF Lifestyle (Closed) Fund is made up of cash and Gilts investments which are return-seeking and liability-matching funds.

The self-select options include return-seeking and liability-matching funds, allowing members to target an appropriate expected return for their requirements.

Risk management

The Trustee recognises that members’ DC retirement savings are dependent on the amount of money paid into their individual accounts and the performance (after charges) of the assets in which they invest.

Additionally, the Trustee recognises that members face many different types of risks through their investment in the Fund. These risks include (but are not limited to) interest rate risk, inflation risk, currency risk, counterparty risk, credit risk, market risk, climate-related risk, liquidity risk, and manager risk. As such, the assets offered within the Lifestyle Funds and any additional investment options should be suitable for managing the risks members face.

The Trustee aims to manage these risks on behalf of members through the following actions:

- Diversification of investments across asset classes, which can be used to manage the above mentioned risks, providing a broadly diversified default investment strategy and a range of other asset class funds for members to invest in;

- Appropriate monitoring of the investment options offered through the Fund, including periodic monitoring of market developments, fund performance, climate and ESG metrics, stewardship, investment manager developments, value for money and asset security;

- Structuring of the default investment strategy to reduce market risk and interest rate risk as a member gets closer to retirement age resulting in a balanced mix of investments broadly aligned with the range of retirement options available to members with DC benefits;

- Ensuring members are aware of the risks inherent with investing their DC retirement savings, through the provision of a library of documents, a modelling tool and ongoing communications following significant market developments;

- Appropriate internal investment controls and processes used by OPAM and the investment managers; and

- The Trustee invests in funds, including the Lifestyle Funds, which are typically daily dealt, investing in assets that are sufficiently liquid to allow them to be realised readily. This reduces the risk of redemption delays when members require their benefits. The Trustee currently has no plans to invest in illiquid assets. Responsibility for buying and selling investments has been delegated to the investment managers.

The Trustee will also continue to develop climate change risk management goals in support of its net zero ambition, and to integrate and manage the consideration of these issues within the DC arrangements’ investments.

Member considerations

The Trustee regularly reviews the Lifestyle Funds (the DC section’s default investment strategies) of both Sections and in doing so considers the characteristics of the current membership with DC benefits. The characteristics considered include:

- The value of DC retirement savings across the membership;

- Whether members have other benefits in the Fund; and

- How members are accessing their retirement savings.

The most recent review identified that there are a range of members with differing DC pot values, retirement needs and that many members have other retirement savings within the UKRF. This highlighted that it remains appropriate to follow an approach of designing a default that is fit for members accessing monies flexibly.

Back to top

UKRF DC default investment strategy

In cases where members did not indicate in which funds they wanted their contributions invested when joining the Fund, the default option was that the contributions were invested in one of the Lifestyle Funds (which comprises the UKRF Lifestyle Fund and the UKRF Lifestyle (Closed) Mature Fund), with a target of accessing their pension savings at age 60 (i.e. the target date or year of maturity of their Lifestyle Fund). Members should review ePA to see where they are currently invested.

The Trustee regularly reviews the default investment strategy and in doing so considers the characteristics of the current membership. The characteristics considered include the likely value of DC retirement savings across the membership, whether members have other benefits in the Fund and how members are accessing their retirement savings. The most recent review identified that there are a large number of members with small DC pots and that members are using a variety of methods to access their retirement savings. The review also noted that many members have other savings within the UKRF, for example DB or cash balance savings.

What is the objective of the default option?

The investment objective of both the Lifestyle Funds is to generate capital growth over the long term and provide increasing levels of capital and retirement income protection as a member approaches their target date. Investments in the Lifestyle Funds are made primarily through exposure to the UKRF Diversified Growth Fund (more information regarding which is further detailed below) and index-tracking funds. This approach means the Lifestyle Funds have a low turnover of investments, and also means they are widely diversified.

How does the asset allocation change as a member approaches their target retirement date?

The Lifestyle Funds use a series of funds during the ten-year period before each member’s target retirement date which are designed to phase investments towards how members are expected to access their DC retirement savings. The Trustee has determined the investment strategies for both the UKRF Lifestyle Fund and the UKRF Lifestyle (Closed) Fund and sets how the amounts invested in each vary over time.

The table below outlines the various stages of the UKRF Lifestyle Fund as a member approaches their target retirement date.

| Name of Fund |

For what period is this Fund used? |

What assets are in the Fund? |

What is the aim of the Fund? |

UKRF Lifestyle (year of maturity) Fund

e.g. UKRF Lifestyle 2040 Fund

|

|

More than 10 years from target retirement date

|

|

Within 10 years leading up to target retirement date

|

|

|

For what period is this Fund used?

What assets are in the Fund?

|

|

More than 10 years from target date

UKRF Diversified Growth Fund which contains a diversified mixture of assets

|

|

Within 10 years leading up to target date

Gilts and cash are steadily introduced as members approach their target retirement date

|

|

What is the aim of the Fund?

Over the long term this fund offers the potential for growth in excess of inflation while preparing members savings to broadly align with the wide range of retirement options that are available

|

|

UKRF Lifestyle Mature Fund

|

For what period is this Fund used?

After reaching target retirement date

|

What assets are in the Fund?

45% UKRF Diversified Growth Fund, 30% UKRF Over 15 years UK Gilt Index Fund, 25% UKRF Cash Fund

|

What is the aim of the Fund?

To be broadly aligned to the wide range of retirement options available to members

|

The diagram below shows how the assets of the UKRF Lifestyle Fund changes as a member approaches their target retirement date:

What is the policy on investing in illiquid assets within the default option?

The Trustee is open to investing in illiquid assets, if member demographics and dynamics in the investment landscape make it appropriate to do so.

The Trustee believes that the reduced liquidity and higher complexity of these investments, along with the fees currently available in the market for illiquid DC funds, makes them unsuitable for the default arrangement at this time. Consequently, the default arrangement for the Fund does not currently invest directly in illiquid assets such as private equity, infrastructure and real estate.

The Trustee has no immediate plans to introduce illiquid assets to the default strategy, noting uncertainty at the time of writing around the outlook for private markets asset classes. The Trustee will, however, review this policy periodically and may consider introducing some allocation to illiquid assets if external market dynamics and member demographics change.

The table below outlines the various stages of the UKRF Lifestyle (Closed) Fund which is a former default option still used by a number of members following an investment change introduced in February 2017.

| Name of Fund |

For what period is this Fund used? |

What assets are in the Fund? |

What is the aim of the Fund? |

UKRF Lifestyle (Closed) (year of maturity) Fund*

e.g. UKRF Lifestyle (Closed) 2020 Fund

|

|

More than 10 years from target retirement date

|

|

Within 10 years leading up to target date

|

|

|

For what period is this Fund used?

What assets are in the Fund?

|

|

More than 10 years from target date

UKRF Diversified Growth Fund which contains a diversified mixture of assets

|

|

Within 10 years leading up to target date

Gilts and cash are steadily introduced as members approach their target retirement date

|

|

What is the aim of the Fund?

Over the long term this fund offers the potential for growth in excess of inflation while preparing members’ savings to broadly align with taking a 25% cash lump sum and buying an annuity

|

|

UKRF Lifestyle (Closed) Mature Fund

|

For what period is this Fund used?

After reaching target date

|

What assets are in the Fund?

75% UKRF Over 15 years UK Gilt Index Fund, 25% UKRF Cash Fund

|

What is the aim of the Fund?

To broadly align with taking a 25% cash lump sum and buying an annuity

|

*All target dated funds in the UKRF Lifestyle (Closed) Fund range have moved into the UKRF Lifestyle (Closed) Mature Fund.

The diagram below shows how the assets of the UKRF Lifestyle (Closed) Fund changes as a member approached their target retirement date:

Further details on the investment strategy of the Lifestyle Funds are included in Your Defined Contribution Investment Guide.

Back to top

With profit policies

Who are these assets invested with?

Some members of the Barclays Bank Section also have investments in three with-profit policies provided by Aviva (manager of 2 policies) and Phoenix Life. These assets are not held within the Fund and therefore are not governed by the principles outlined in this SIP.

Are these policies still open?

There are no further contributions being paid into these policies in respect of Fund members.

How are these assets invested?

Each policy invests 100% in a with-profit fund, managed by each respective provider.

With-profit funds are pooled investment funds, which combine the assets of all investors to provide exposure to a range of asset classes.

Each fund is managed in line with its published Principles and Practices of Financial Management (PPFM); however, the provider does have some discretion over how this is achieved.

How do with-profit funds work?

The value of a with-profit fund is not directly linked to the value of the underlying assets. Instead, returns over the period are smoothed by retaining some profits in periods of higher growth and paying out more during periods of lower growth. This is known as smoothing and is achieved through adding a combination of regular bonuses and final bonuses.

Regular bonuses are paid annually and represent the amount that the with-profit fund manager believes appropriate to be passed onto members. There is usually no guarantee that regular bonuses will be paid. Once paid however, they cannot be taken away providing the member keeps their investment in the policy until retirement or death.

Final bonuses (also known as terminal bonuses) may be added when benefits are paid. These are not guaranteed and will depend on a variety of factors including the fund performance over the period of investment, bonuses already paid, expenses etc.

Back to top