Ben’s choice

Because Ben had other retirement savings, which would provide him with more than sufficient income in retirement, he wanted to take this pension as a cash lump sum. So, after taking financial advice, he transferred out of the Plan, took a cash lump sum and used the money, after tax, to enjoy his hobbies.

Ben’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Summary of this option

Here is a list of things that this option provides or doesn’t provide. Have a look through and see if what this option offers might suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Taking a single cash lump sum will not provide you with the reassurance of a regular income for life. |

| Benefit: Pension increases to protect against inflation | Available with this option?No | Notes: You will not have any guaranteed protection against increases in the cost of living (inflation). |

| Benefit: A pension for my eligible dependant on my death | Available with this option?No | Notes: You can leave any leftover money to your eligible dependant but there is no pension payable to them. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: If you don’t invest the money. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You get all of it (some of which is subject to tax and you may get a large tax bill). |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your remaining money to your dependants when you die. |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: It's a single cash lump sum. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: You can choose to invest any of your money through self-investment. |

| Benefit: Suitable if I expect to live a long time | Available with this option?No | Notes: You control how much you spend over time, so this depends on how you manage your money and how long you live. |

Tax

Tax-free income

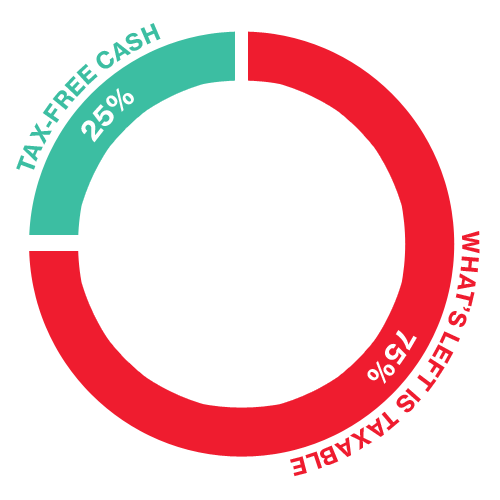

- You can currently take some of your benefits as tax-free cash (usually up to 25% of your transfer value).

Income subject to tax

- The remainder of your cash lump sum is taxed at your marginal rate of income tax for that year

- Taking all of your benefits as a single cash lump sum is likely to increase the amount of tax you pay as the lump sum will increase your income in the year you take your benefits

- You may need to pay further tax charges on any investment returns generated if you invest the cash lump sum outside of a pension / drawdown arrangement