Sally’s choice

For Sally, a pension that could provide a regular income for life for her, and her husband Jim if she died first, and which provided protection against future increases in the costs of living, gave her the peace-of-mind she needed. So, she decided not to transfer out of the Plan and took the Plan pension.

Sally’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Summary of this option

Here is a list of things that this option provides or doesn’t provide. Have a look through and see if what this option offers might suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?Yes | Notes:

Taking your pension from the Plan gives you the reassurance of a regular income paid, normally monthly, to you for as long as you live, a bit like your salary is now. This is particularly useful if:

|

| Benefit: Pension increases to protect against inflation | Available with this option?Yes | Notes: Your Plan pension may, depending on when your pension was built up in the Plan, increase in value each year to protect you against increases in the cost of living (inflation). By this we mean as the cost of things like fuel, bread, milk etc. go up, your pension income may also do so. |

| Benefit: A pension for my eligible dependant on my death | Available with this option?Yes | Notes:

Your Plan pension will provide an income to your eligible dependant when you die, giving additional reassurance for you and your loved ones. A pension may also be payable to your children. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: Yes, you don’t have to do anything, your pension will be paid to you regularly, just like your salary is now. |

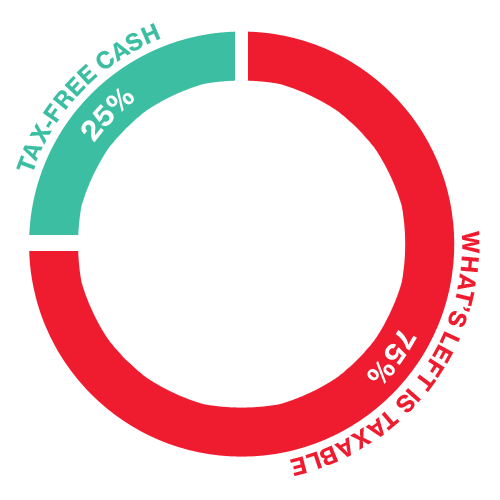

| Benefit: Money to use now | Available with this option?Yes | Notes: In exchange for a reduced regular income from the Plan, you can typically take up to 25% (one quarter) of the value of your pension as, a tax-free cash lump sum when you retire. |

| Benefit: Leaving an “inheritance” | Available with this option?No | Notes: You will receive a pension for your eligible dependant as outlined above. If you die within the first five years of retirement, a lump sum will be paid equivalent to the remaining pension instalments which would have been paid for those five years (without increases). |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: There is no flexibility to change your pension from the Plan once you retire, your pension will increase each year in line with the Plan rules. |

| Benefit: The ability to invest my money myself | Available with this option?No | Notes: There is no option to manage any investments. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Yes | Notes: Your Plan pension will be paid to you for as long as you live. |

Tax

Tax-free cash lump sum

- You can typically take some of your Plan Pension as tax-free cash (up to a maximum permitted by HMRC)

- The amount of the tax-free cash lump sum depends on the terms offered by the Plan. and is subject to the Lump Sum Allowance (see Tax and Allowances section).

Income (subject to tax)

- Your annual income will be taxed at your marginal rate of income tax for that year

- As your pension income is relatively stable, you can expect to pay a similar level of tax each year (subject to any other income you have and any changes in tax rates).