How long might you live?

It’s actually someone’s job to try to work this out! A typical 65-year-old, in good health, in January 2022 could expect to reach an age of:

So, if you retire at age 65, you could live for at least 20 years after that. That’s 20 years of paying for the things you’ll need and want.

To find out more about Life Expectancy and to use a tool to get an idea of your own personal life expectancy, visit this page of the site.

Why this option might suit you

Here’s a list of things this option does or doesn’t provide. Have a look through and see which suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?Yes | Notes:

Buying a regular income for life (an annuity) from an insurance company gives you the reassurance of a regular income paid to you for as long as you live. This is particularly useful if:

|

| Benefit: Pension increases to protect against inflation | Available with this option?Optional | Notes: You can choose to buy an annuity that increases in value each year to protect you against increases in the cost of living (inflation), by this we mean as the cost of things like fuel, bread, milk etc. go up, so does your pension income. This comes at the cost of a lower initial income. |

| Benefit: A pension for my spouse / partner on my death | Available with this option?Optional | Notes: You can choose to buy a joint-life annuity and could choose to include a guarantee period. A joint-life annuity will provide an income to your spouse or partner when you die, and a guarantee period will provide a lump sum if you die soon after retirement, giving additional reassurance for you and your loved ones. This comes at the cost of a reduction in how much money you get each month. You can read more below in the section 'Income for life annuity options'. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: Super easy, once you've bought your annuity, the income from it will be paid to you regularly, just like your salary is now. |

| Benefit: Money to use now | Available with this option?Yes | Notes: In exchange for a reduced regular income from your annuity, you can take up to 25% of the value of your pension savings as a tax-free cash lump sum when you retire. |

| Benefit: Leaving an inheritance | Available with this option?No | Notes: But there are some options to provide an income for your loved ones on your death. You can read more below in the section 'Income for life annuity options'. |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: The amount you receive from your annuity is fixed. If you choose an increasing annuity, the automatic yearly increases will be the only change to the amount you receive. |

| Benefit: The ability to invest my money myself | Available with this option?No | Notes: There is no option to manage any investments. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Yes | Notes: Definitely. Your annuity will be paid to you for as long as you live. |

Income for life (annuity) options

What are your options if you buy a regular income for life (an annuity)?

| Feature | Option 1 | Option 2 | Comparison |

|---|---|---|---|

| FeaturePension increases | Option 1An income which increases during retirement, either at a fixed rate or based on inflation. This is known as an ‘increasing annuity’. |

Option 2An income which remains level throughout retirement. This is known as a ‘level annuity’. |

Comparison

|

| FeatureSpouse / partner pension | Option 1An income which continues to be paid to your spouse or civil partner upon your death (usually at a reduced level). This is known as an ‘joint life annuity’. |

Option 2An income which ceases on your death. This is known as a ‘single life annuity’. |

ComparisonAn annuity which includes an income for your spouse or civil partner after your death will be lower than an annuity paid just to you, as there is a chance that it will be paid for longer. |

| FeatureGuarantee period | Option 1An income which is guaranteed to be paid for a minimum period, even if you die within that period. This is known as an annuity with a ‘Guarantee period’. |

Option 2An income which stops on your death (or the death of your spouse or civil partner) even if this is shortly after you purchase the annuity. This is known as an annuity with ‘no Guarantee period’. |

Comparison

|

| FeatureHealth / enhanced terms | Option 1An income which does not take into account your health or lifestyle. This is known as a ‘standard annuity’. |

Option 2An income which takes into account your health or lifestyle. This is known as an ‘enhanced annuity’. |

Comparison

|

How do I buy an annuity?

Different annuity providers offer different rates for different types of annuity. So while you may be able to buy an annuity from your current pension provider, you may be able to secure a higher income, or an income that better suits your needs, by shopping around. This is often referred to as an ‘Open Market Option’. You can shop around yourself, or you can use an annuity comparison service.

Tax

Tax-free income

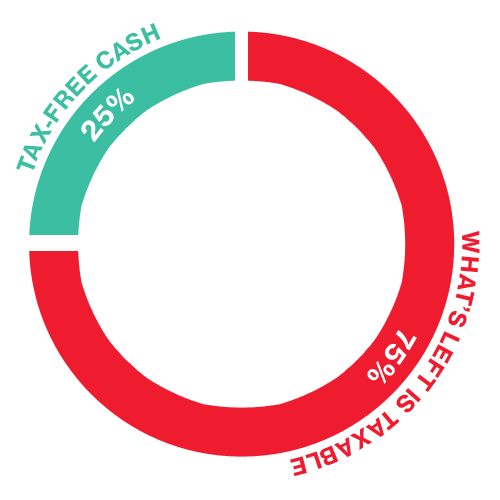

- You can take up to 25% of your pension savings as a tax-free cash lump sum.

Income (subject to tax)

- Your annual income will be taxed at your marginal rate of income tax for that year

- As your annuity income is stable, you can expect to pay a similar level of tax each year (subject to any other income you have and any changes in tax rates).

Meet Harold

Harold’s always been a character. He didn’t expect to fall in love with the wildly successful owner of a large luxury goods retailer, but you can’t choose who you love. He’s thought about popping the question, but marriage was never for them.

Harold has decided to delay taking his retirement savings for the time being. He plans to buy a tailor-made annuity, as it’s likely he won’t need to provide for his partner.

Harold prioritised…

Pension increases to protect against inflation

He wanted to make sure he could still afford his lifestyle later in his retirement so wanted his income to increase in line with inflation. He could choose an increasing annuity.

The reassurance of a regular income for life

Harold wanted a simple, low maintenance, regular income that he could rely on.

A pension of my spouse / partner on my death

He wanted to maximise his income by choosing a single-life annuity, as he will not need to provide for his partner in retirement.

Pension increases to protect against inflation

He wanted to make sure he could still afford his lifestyle later in his retirement so wanted his income to increase in line with inflation. He could choose an increasing annuity.

The reassurance of a regular income for life

Harold wanted a simple, low maintenance, regular income that he could rely on.

A pension of my spouse / partner on my death

He wanted to maximise his income by choosing a single-life annuity, as he will not need to provide for his partner in retirement.