How long might you live?

It’s actually someone’s job to try to work this out! A typical 65-year-old, in good health, in December 2019 could expect to reach an age of:

So, if you retire at age 65, you could live for at least 20 years after that. That’s 20 years of paying for the things you’ll need and want.

To find out more about Life Expectancy and to use a tool to get an idea of your own personal life expectancy, visit this page of the site.

Why this option might suit you

Here’s a list of things this option does or doesn’t provide. Have a look through and see which suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Taking a cash lump sum will not provide you with an income. |

| Benefit: Pension increases to protect against inflation | Available with this option?No | Notes: You will not have any guaranteed protection against increases in the cost of living (inflation). |

| Benefit: A pension for my spouse / partner on my death | Available with this option?No | Notes: You can leave any leftover money to your spouse / partner in your Will, but there is no pension payable to them. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: If you don’t invest the money. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You get all of it (some of which is subject to tax and you may get a large tax bill). |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your remaining money to your dependants when you die. |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: It's a single cash lump sum. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: You can choose to invest any of your money through self-investment. |

| Benefit: Suitable if I expect to live a long time | Available with this option?No | Notes: You would receive your savings in one lump sum. However, you may have other retirement savings that could provide an income for your lifetime. |

Tax

Tax-free income

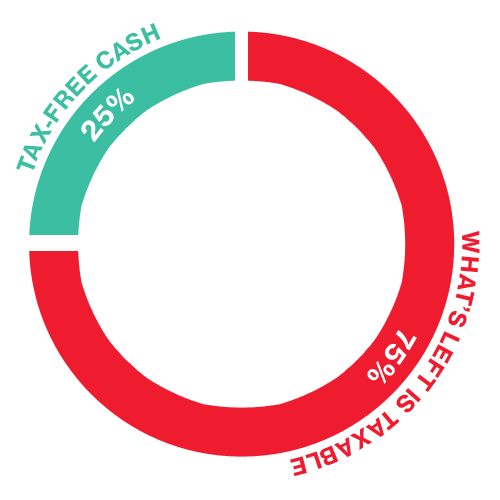

- You can take some of your benefits as tax-free cash (usually up to 25% of their value).

Income subject to tax

- The remainder of your cash lump sum is taxed at your marginal rate of income tax for that year

- Taking all of your benefits as a single cash lump sum is likely to increase the amount of tax you pay as the lump sum will increase your income in the year you take your benefits

- You may need to pay further tax charges on any investment returns generated if you invest the cash lump sum outside of a pension / drawdown arrangement.

Future pension savings – warning!

Once you have taken a taxable cash lump sum, the amount that you (and your employer on your behalf) can save into a defined contribution pension in future without incurring a tax charge will reduce, due to a restriction known as the Money Purchase Annual Allowance.

You will need to consider this if you are planning to contribute to a pension in future.

You will need to make sure that you tell any other defined contribution pension arrangements that you are continuing to save into that you are subject to the Money Purchase Annual Allowance so that they can assess your contributions against this lower level.

To assist you with this notification, your pension provider should send you a ‘flexible-access statement’ within 31 days of you first taking a taxable withdrawal. You will then need to let your other pension providers know within 13 weeks of receiving your ‘flexible-access statement’, or within 13 weeks of starting to make new contributions to a defined contribution pension otherwise you may be subject to a fine.

How you can take a cash lump sum?

Not all workplace pension schemes let you take all of your pension savings directly from the Plan. In this case, you’d need to transfer your pension savings to another pension arrangement which allows this, such as a Drawdown account, and then take a cash lump sum from your new arrangement.

Meet Ben

Ben only worked at Honeywell for a few years and whilst he built up a decent amount of pension savings in that time, it’s not his main source of retirement income, that’ll come from the Government job he spent 30 years at. As such, he decided to cash in his Honeywell savings to treat himself.

As a big footie fan, Ben’s going to use his cash to follow his favourite team around Europe and make the most of his first few years of retirement before settling in to more of a routine.

Ben prioritised…

Money to use now

Even though he had a large tax bill to settle from taking his entire account as cash, Ben wanted all his savings as soon as he retired.

The flexibility to change my income when I like / need

He wanted the freedom to retire early and fulfil his football dreams.

Suitable if I expect to live a long time

This wasn’t a concern for Ben, his other pension will tick that box.