Strategy

Climate-related scenario analysis

To better understand and quantify climate-related risks, the Trustee employed Aon to conduct scenario analysis using five different climate change scenarios: no transition, disorderly, abrupt, orderly, and smooth transitions.

Read more

These scenarios were chosen in order to provide a reasonable range of plausible climate change pathways over the time horizons that the Trustee is concerned about.

The “base case” scenario is based on Aon’s current long-term return views of what is currently priced into the market and implies a temperature rise of approximately 1.8℃. This and the other scenarios considered are outlined in the table below.

Three of the scenarios considered are expected to deliver warming of 2℃ or less. The most favourable scenario considered is the “smooth transition” scenario, which leads to a temperature rise of less than 2℃.

The scenario analysis considers the potential impact of climate change on both the Fund’s assets and liabilities and, therefore, its funding position.

Potential impact of climate change

Click on the different transition scenarios to understand the impact of climate change.

- Smooth transition < 1.5℃

- Base case ~1.8℃

- Abrupt transition <2℃

- Orderly transition <2℃

- Disorderly transition <3℃

- No transition >4℃

Private sector innovation and a green technology revolution, combined with government coordination, help drive progress towards tackling climate change.

Emission reductions start now and continue in a measured way in line with the objectives of the Paris Agreement and the UK government’s legally binding commitment to reduce emissions in the UK to net zero by 2050. Current pricing suggests that the market does not expect a bad climate change outcome – that is, the effects are not as damaging as first thought, and some progress is made to limit GHG emissions and global warming.

The effects from increasingly extreme weather events in the next five years lead to widespread public concern over climate change. This leads to governments introducing policies to drive a rapid reduction in GHG. Delayed action on reducing emissions mean that the costs of tackling the problem are higher.

Increased public awareness of climate change risks galvanises opinion and leads to governments undertaking widespread action globally to aggressively mitigate and adapt to climate change. A high global GHG tax and carbon cap is introduced.

The world economy continues taking a "business as usual" approach. Eventually, market participants begin to fully grasp the implications of climate change and there is a growing realisation that current levels of action are inadequate. Market values price in high levels of economic damage and the irreversible loss.

The world economy remains oriented towards improving near-term economic prospects, with companies and governments taking a "business as usual" approach. While some climate change policies are implemented, global efforts are insufficient to halt significant global warming. Impacts from physical risks gradually become more severe over time and some become irreversible by 2100 as tipping points are crossed.

Source: Aon

Note: Degree warming is relative to pre-industrial levels by 2100.

The climate scenario analysis was carried out on the Fund’s asset allocation at 30 September 2021, assuming a static portfolio with no subsequent allocation changes. Since the Fund is maturing, this is considered to be a conservative approach.

Summary of the analysis

Based on the climate scenario analysis, the following conclusions were drawn:

- The Main Section’s investment portfolio and funding level exhibits good resilience under the climate change scenarios due to high diversification of assets, low proportion of equities and high levels of hedging against changes in interest rates and inflation.

- NatWest Markets (NWM) and Royal Bank of Scotland International Limited (RBSI) Sections also demonstrate reasonable resilience under the climate change scenarios.

- Overall, climate risks are the lowest for the AA Section due to the absence of quoted/private equity.

After reviewing the climate scenario analysis, the Trustee is comfortable that the Sections display sufficient resilience to the potential impacts of climate change as envisaged by Aon’s proprietary models, and at this stage are not proposing any material changes to investment strategy as a result.

Whilst the scenario analysis indicates that, even under adverse climate scenarios, the funding level of the various Sections is relatively resilient, the Trustee will use the analysis when considering sponsor covenant and the impact of possible future funding shocks.

The Trustee will review the appropriateness of the climate scenario analysis on an annual basis with the next review expected to take place in November 2022. The Trustee expects to update the climate scenario analysis at least triennially – this may be undertaken sooner if there are material developments affecting the Fund (or each Section), which would include any changes to the strategic asset allocation.

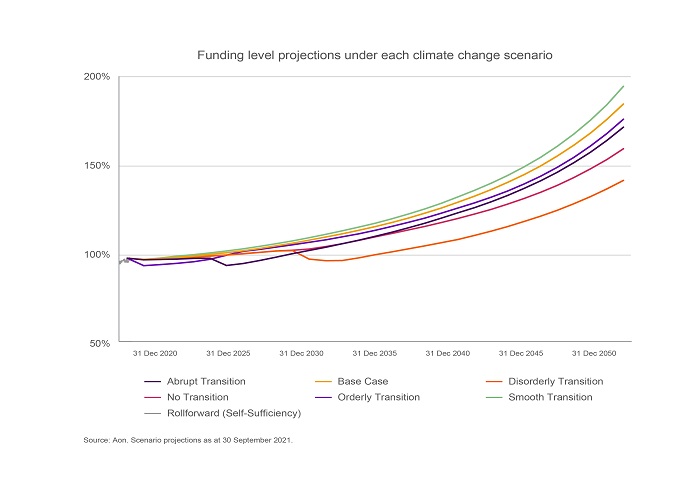

The Fund’s investment portfolio exhibits good resilience under the climate scenarios over the 30-year projection period. This is due to the diversification of assets, low proportion of equities and high levels of hedging against changes in interest rates and inflation.

The worst-case scenario for the Fund is the disorderly transition. Although initially the funding level improves (albeit at a slower rate than the base case), after 10 years the funding level deteriorates modestly. Although the Fund is left materially worse off relative to the base case by the end of the modelling period, there is still expected to be a positive funding surplus. The strong starting position and diversified strategy reduces the downside impact of the disorderly scenario on the Fund. Despite the resilience of the investment strategy, the funding level is volatile under some of the scenarios. For example, under the abrupt transition the Fund experiences a c. 4% fall in the funding level, which leads to a lag in the time taken to reach full funding, relative to the base case, of around seven years. Deterioration of the funding level may place a strain on the Sponsor covenant as they may have to make up a bigger shortfall through deficit contributions. It may also require the Fund to re-risk in order to stay on track to achieve the funding target, or extend the timeframe for achieving this.

Funding level projections under each climate change scenario

Source: Aon. Scenario projections as at 30 September 2021.

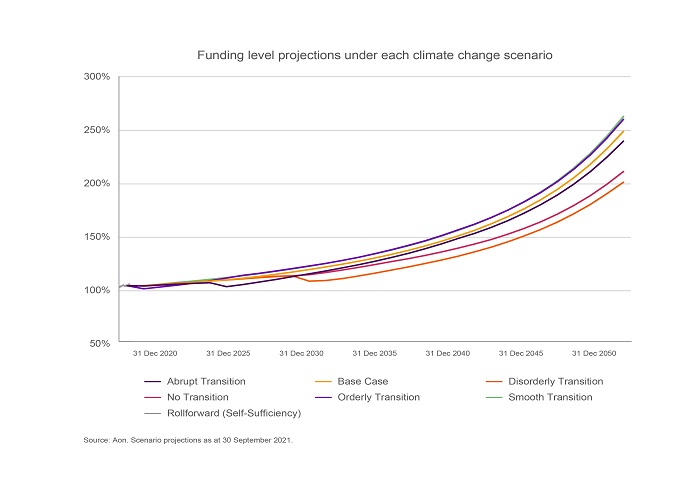

The AA Section’s investment portfolio displays strong resilience to climate change risk over the 30-year projection period. This is due to the absence of traditional equity in the portfolio, as well as the high levels of hedging to protect against changes in interest rates and inflation.

As with Main Section, the worst-case scenario for the AA Section is the disorderly transition. However, owing to the strong starting funding position and the more defensive investment strategy, the downward shock is not sufficient to reduce funding to below 100% after several years of growing surplus. Although the Fund is again left materially worse off relative to the base case by the end of the modelling period, the strong starting position and low risk strategy mitigates the downside impact on the Fund.

One key difference relative to Main Section is the muted impact of the orderly transition scenario. This reflects the smaller allocation to non-credit growth assets (and notably the absence of traditional equity). The muted funding drop leaves the Fund in a strong position to benefit from stronger post-transition returns, with funding (under the orderly scenario) overtaking the base case from year 5 onwards. Given the full funding position on this Section, the climate scenario analysis suggests that the impact on the funding level will be muted.

Funding level projections under each climate change scenario

Source: Aon. Scenario projections as at 30 September 2021.

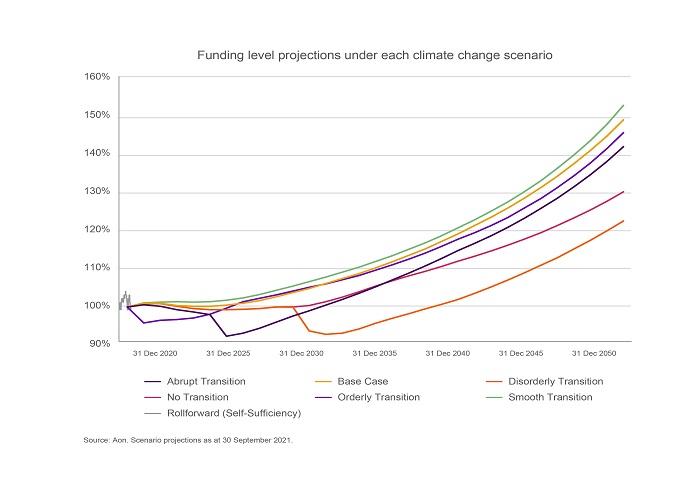

The Fund’s investment portfolio exhibits some resilience under the climate scenarios. As with Main Section, this is due to the low proportion of equities and high levels of hedging to protect against changes in interest rates and inflation.

As with Main and AA Sections, the worst-case scenario for the NWM Section is the disorderly transition. However, the higher proportion in growth assets results in the Fund being more exposed to climate risks than the other two Sections (even though much of the growth allocation is in credit). This results in a slightly larger funding drop under the disorderly transition scenario than is seen for the other two Sections, with the funding level falling significantly during the transition.

The downside to climate risk is also demonstrated under the orderly/abrupt transition scenarios, but subsequent recoveries are borne out much earlier than under the disorderly transition. This allows funding to recover much closer to the base case by the end of the 30-year modelling period. Deterioration of the funding level may place a strain on the Sponsor covenant as they may have to make up a bigger shortfall through deficit contributions. It may also require the Fund to re-risk in order to stay on track to achieve the funding target, or extend the timeframe for achieving this.

Funding level projections under each climate change scenario

Source: Aon. Scenario projections as at 30 September 2021.

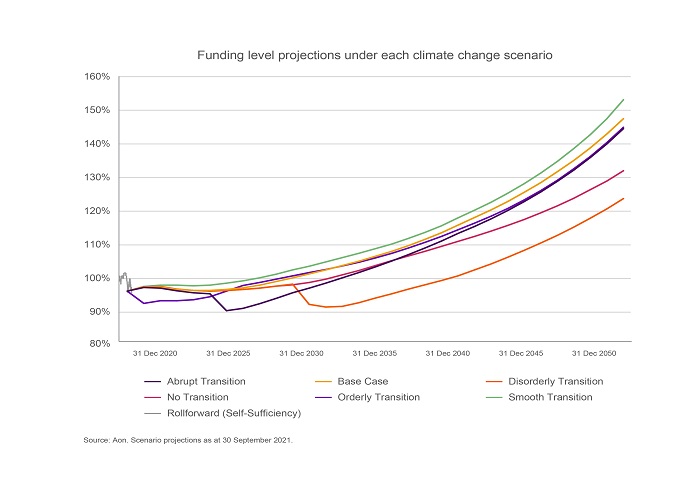

The RBSI Section’s investment portfolio exhibits some resilience under the climate scenarios. As with Main and NWM Sections, this is due to the low proportion of equities and high levels of hedging to protect against changes in interest rates and inflation.

As with Main, AA and NWM Sections, the worst-case scenario for the RBSI Section is the disorderly transition. The pattern seen is very similar to NWM Section, with the funding level dropping significantly as the transition occurs. Again, this reflects the higher proportion of growth assets when comparing to Main or AA Sections.

The slightly higher exposure to climate risks is also seen under the abrupt transition scenario, with full funding delayed relative to the base case after the transition shock. Deterioration of the funding level may place a strain on the Sponsor covenant as they may have to make up a bigger shortfall through deficit contributions. It may also require the Fund to re-risk in order to stay on track to achieve the funding target, or extend the timeframe for achieving this.

Funding level projections under each climate change scenario

Source: Aon. Scenario projections as at 30 September 2021.

Business, strategy, and financial planning

The Trustee recognises the importance of climate change and the risk it poses to the Fund. The Trustee takes climate-related risks into account in determining its investment strategy. The Trustee has committed to engaging with all companies it invests in to encourage them to achieve net zero emissions in line with the Paris Agreement and has set out its intended actions to achieve this goal. The commitment can be found here.

The Trustee also recognises that climate change may have an impact on employer covenant. The Trustee monitors the covenant on a regular basis, with the support of its covenant adviser, and maintains a regular dialogue with the employer.

Climate-related risks and opportunities

The Trustee considers climate-related risks and opportunities over the short, medium and long-term time horizons identified earlier in the Governance section. The Trustee has determined which risks and opportunities might have a material impact on the Fund through qualitative assessment of climate-related risks and opportunities, and asset-class-level scenario testing of longer-term ‘strategic’ risks and opportunities. Climate risk considerations are incorporated throughout the investment process, from strategic asset allocation to manager selection and portfolio monitoring.

Read more

Climate change may impact the financial performance of companies and therefore also the risk-return profile of the securities they issue. The Trustee acknowledges that each of the Fund’s investments may be exposed to climate-related risks to varying extents, and has identified two specific types of risk which could impact the Fund’s investment and funding strategy:

-

Physical risks

Are the risks associated with the physical impacts of climate change on companies’ operations. Physical risks may be:

- Acute: severe and extreme events and location-specific (e.g., droughts, heatwaves, storms, wildfires, etc); or

- Chronic: represents the background incremental changes in, for example: temperature, precipitation, and sea-level rise over several decades.

The Fund is most directly exposed to these risks through its real estate, forestry, and infrastructure holdings, but they are also expected to indirectly impact other asset classes too.

Greenhouse, Cambridgeshire. Uses ground source heat pumps and reduces reliance food miles.

Image by Greencoat Capital.

-

Transition risks

Are those associated with the transition towards a low-carbon economy. For example, shifts in regulation, introduction of new (or withdrawal of obsolete) technology, broad effects on the market, and individual entity reputation. These are expected to emerge more rapidly than physical risks and have a larger impact over the short to medium-term. These risks are likely to impact all asset classes.

In addition, the Trustee is alert to both the reputational risk associated with climate risk and potential for it to have an impact on the employer covenant.

Climate risk assessment

The Trustee has undertaken a qualitative assessment of possible climate change related effects on its portfolio via a fund manager questionnaire to identify financially material climate-related risks and opportunities associated with each mandate, over the appropriate short (5 years), medium (10 years) and long-term (30 years) horizons. The following scale was used to assess the asset classes:

| denotes a high level of financial exposure to the risk under consideration. | |

| denotes a medium level of financial exposure to the risk under consideration. | |

| denotes a low level of financial exposure to the risk under consideration. |

The summary of the assessment for each asset class is captured below. In every asset class, the Trustee works closely with the managers to understand their risk exposure and the mitigations being undertaken.

The Fund’s hedging assets are invested in UK Government bonds, cash instruments and swaps to manage risk versus the Fund’s liabilities. Most governments in developed markets – including the UK – have set carbon reduction targets. These assets provide a good level of protection against interest and inflation rate changes that might arise from climate-related risks (for example, inflation caused by higher asset costs that could arise from climate-related transition risks).

| Physical risks | Transition risks | |||||

|---|---|---|---|---|---|---|

| Time horizon | Physical risksAcute | Physical risksChronic | Transition risksRegulatory | Transition risksTechnology | Transition risksMarket | Transition risksReputation |

| Short | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Medium | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Long | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

Note: This table is based on Aon’s assessment of the climate risk of UK Government bonds.

Hedging asset allocation as at 31 December 2021

Credit is the Fund’s second largest allocation and includes a broad spectrum of investments, such as investment grade securities, distressed credit, real estate debt and infrastructure debt investments.

Read more

Credit markets generally have a high exposure to transition risk. Issuers that are slower to participate in the transition to a low carbon economy are likely to face reputational damage. Also, the potential for unexpected and aggressive emissions regulation may create higher costs (e.g., carbon taxes) for companies. Unanticipated regulation could leave some sectors with significant stranded assets. These and other transition risks could lead to increased risk of downgrade or default.

In the near term, transition risks are far less evident for emerging markets assets and entities, where solid legislation and regulation around greenhouse gas (GHG) emissions are generally not yet present. Substitution and transition to cleaner energy require alternatives and these are still in the early stages of development. However, the risks are anticipated to be more pronounced in the future, as efforts to reduce climate change are embraced globally and not just in the developed world.

The Trustee mitigates transition risk by not owning investment grade oil and gas debt with a maturity greater than 2025, and not lending to entities where more than 50% of revenue is derived from extraction of thermal coal.

The analysis from investment managers indicates that the Trustee’s credit portfolio (which is actively managed) is potentially less susceptible to transition risk than the credit market as a whole.

Note that the analysis focuses on the climate change impacts on credit risk, rather than on underlying interest rates.

| Physical risks | Transition risks | |||||

|---|---|---|---|---|---|---|

| Time horizon | Physical risksAcute | Physical risksChronic | Transition risksRegulatory | Transition risksTechnology | Transition risksMarket | Transition risksReputation |

| Short | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Medium | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Long | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

Note: based on the manager data.

Credit allocation as at 31 December 2021

While the Fund’s quoted equities are exposed to market and reputation risks associated with the change in the consumer preference and overall market sentiment, following engagement with its managers, the Trustee believes the asset class displays a forward-looking approach to identifying climate-related opportunities.

Read more

Of particular relevance from a climate risk and opportunity perspective is the Fund’s allocation to global forestry, within alternative equity. Alongside the return and diversification benefits of this asset class, it also provides two valuable climate-related features. Firstly, by employing sustainable harvest practices, the forests provide a carbon sink which offsets emissions elsewhere in the portfolio, and secondly the value of the other (harvested) forests is expected to benefit from both increasing carbon prices and demand for timber as a lower carbon substitute for other materials. Nonetheless, the Trustee also recognises that forestry is becoming more exposed to wildfires. The Trustee believes that the forest management to mitigate climate-related risks may call for adaptation of silvicultural practices, as well as technological interventions, to enable improved prediction and identification of extreme weather events. Analysis from the Trustee’s timber investment manager indicates that physical risks from climate change are low due to the location of the Fund’s timber assets and the ability of the manager to mitigate fire risk for the time being.

Another opportunity the Fund benefits from is in relation to renewable energy via wind farms, waste to energy and anaerobic digestion. The Trustee values this investment due to its positive environmental benefits and its contribution to reducing the UK’s reliance on fossil-fuel energy generation.

| Physical risks | Transition risks | |||||

|---|---|---|---|---|---|---|

| Time horizon | Physical risksAcute | Physical risksChronic | Transition risksRegulatory | Transition risksTechnology | Transition risksMarket | Transition risksReputation |

| Short | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Medium | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Long | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

Note: based on the manager data.

The assessment has been undertaken in relation to public, private and ‘alternative’ equity, which taken together, are the Fund’s third largest asset class exposure.

Equity allocation as at 31 December 2021

Property assets are likely to be impacted by a combination of physical and transition risks. Physical risks arising from climate change could lead to property damage and material financial impacts, particularly in geographically vulnerable areas.

Read more

The principal physical climatic risk experienced in the UK is fluvial flooding. Through its holdings in the US, the property portfolio is also exposed to other physical risks such as hurricanes and wildfires.

Transition risks, such as tenants preferring ‘green’ buildings and therefore making some buildings effectively ‘un-rentable’, are significant climate-related issues. Other examples include energy efficiency regulations, increases in energy costs, carbon taxes, and valuation considerations that could lead to increased costs.

The Trustee prohibits new investments in properties that have a high flood risk. The Trustee encourages managers to design new properties with the objective of producing zero emissions once they are operational, such as its investment in the construction of retirement villages in the UK. Managers of existing commercial properties are required to continually improve the operational efficiency of the buildings owned by the Fund and put a plan in place to attain higher energy efficiency ratings in order to mitigate the risk of stranded assets.

| Physical risks | Transition risks | |||||

|---|---|---|---|---|---|---|

| Time horizon | Physical risksAcute | Physical risksChronic | Transition risksRegulatory | Transition risksTechnology | Transition risksMarket | Transition risksReputation |

| Short | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Medium | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Long | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

Note: based on the manager data.

Property is invested across the UK, the US and Europe.

Property allocation as at 31 December 2021

Due to the nature of most insurance contracts the Fund invests in, there are no notable climate-related risks. However, the strategy has indirect immaterial exposure to physical risks through its holdings of catastrophe insurance-linked securities.

| Physical risks | Transition risks | |||||

|---|---|---|---|---|---|---|

| Time horizon | Physical risksAcute | Physical risksChronic | Transition risksRegulatory | Transition risksTechnology | Transition risksMarket | Transition risksReputation |

| Short | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Medium | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

| Long | Physical risks - acute |

Physical risks - chronic |

Transition risks - regulatory |

Transition risks - technology |

Transition risks - market |

Transition risks - reputation |

The Fund invests in insurance-related funds covering a wide range of insurance risks.

Insurance allocation as at 31 December 2021

Climate opportunities assessment

The Fund is closed to new members and therefore the assets and liabilities will decline slowly over the next 30 years. The Trustee employs a low-risk investment strategy with high levels of hedging assets which limit the Trustee’s ability to make new investments. The Trustee believes that the best way to access climate opportunities is through improving the operations of its existing assets and making selected capital expenditure in existing assets where this will provide a financial return over the Fund’s expected investment period.

Lowering timber harvest levels to maintain more stored carbon in the forest biomass.

Image from New Forests Asset Management.