Governance

Governance is the way the Fund operates and the internal processes and controls in place to ensure appropriate oversight. Those undertaking governance activities are responsible for managing climate-related risks and opportunities. This includes the directors of the Trustee and others making decisions impacting the Fund. This includes decisions relating to investment strategy and implementation, funding, the ability of the sponsoring employer to support the Fund and of the Fund to meet its liabilities.

Our Fund’s governance

As the Trustee of the Fund, we are responsible for overseeing all strategic matters related to the Fund. This includes the governance and management frameworks relating to Environmental, Social and Governance (ESG) considerations and climate-related risks and opportunities.

The Trustee’s climate beliefs and approach to managing climate change risk are set out in the Fund’s Statement of Investment Principles (SIP), which is reviewed annually.

Read more

The Trustee directors receive training at least on an annual basis on climate-related issues to ensure that they have the appropriate knowledge and understanding to support good decision-making. During the reporting period, training on climate-related risks took place in May for everyone on the Trustee Board and the Trustee’s investment team.

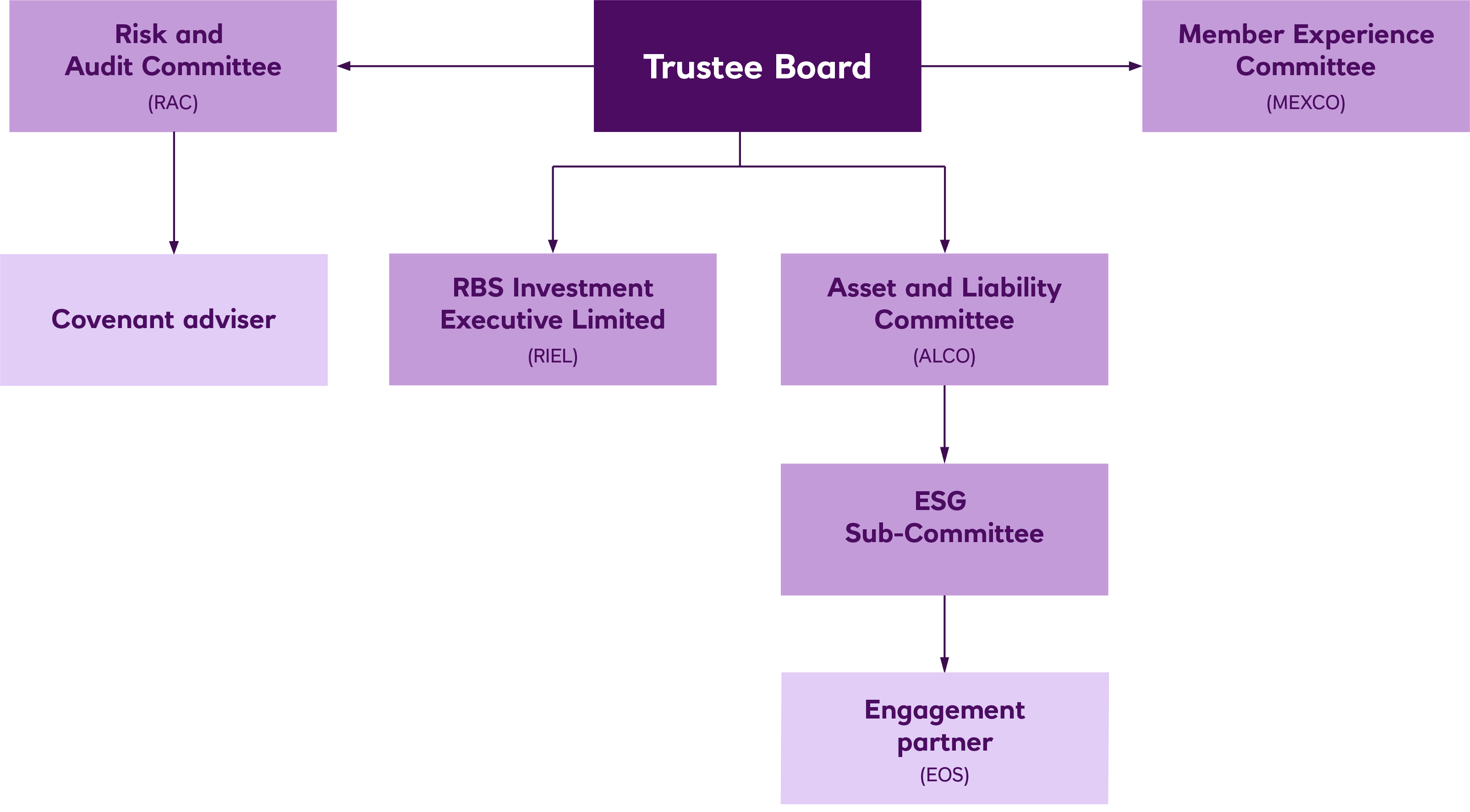

The Trustee is ultimately responsible for oversight of all strategic matters related to the Fund. This includes approval of the governance and management framework relating to ESG considerations and climate-related risks and opportunities. Certain functions within the Trustee’s climate governance framework have been delegated to committees of the Trustee Board. The relevant committees are the Asset and Liability Committee (ALCO), the Environmental, Social and Governance Sub-Committee of ALCO (ESGC), the Risk and Audit Committee (RAC) and the Member Experience Committee (MEXCO). These delegations are summarised below.

Trustee Board map of delegations associated with governance of climate-related risks and opportunities

Our climate beliefs and approach

We believe that ESG performance, including management of the impact of climate change, is fundamental to a company’s enduring success and therefore to its long-term financial returns. We have articulated our approach to asset ownership in our Responsible Ownership Policy (ROP).

We take account of, and instruct our Investment Managers to take account of, financially material considerations in the Fund’s investment programme, including climate-related risks.

We believe that climate-related factors may create investment opportunities. Where possible, and where appropriately aligned with our strategic objectives, we will seek to capture such opportunities through investment in appropriate assets.

We believe that the relevant time horizons over which climate change will be relevant for the Fund’s sections are as follows:

| Main | AA | NWM | RBSI | |

|---|---|---|---|---|

| Short term | Main2025 | AA2025 | NWM2025 | RBSI2025 |

| Medium term | Main2035 | AA2035 | NWM2035 | RBSI2035 |

| Long term | Main2050 | AA2050 | NWM2050 | RBSI2050 |

Role of Trustee Committees

The committees of the Trustee Board have the following key roles:

-

Asset and Liability Committee

Read more

Responsible for the Fund’s investment strategy, including climate and other ESG risks and opportunities. Reviews the Trustee’s ROP at least annually to adapt to changes in the Fund, changes to regulation, industry guidance and best practice. ALCO is responsible for ensuring that investment and actuarial advice adequately incorporates climate-related risk factors where they are relevant and material which it does with assistance from its strategic investment adviser RBS Investment Executive Limited (RIEL). ALCO will monitor and review climate-related investment opportunities.

-

Member Experience Committee

Read more

Responsible for ensuring the Trustee delivers a high-quality service to all members and their representatives. It monitors the administration of the Fund and communication to members, including correspondence on climate-related matters.

Oakleaf Recycling Plant, Staines on Thames, UK.

Image by Greencoat Capital.

-

Risk and Audit Committee

Read more

Responsible for risk oversight, covenant monitoring, audit and assurance. The RAC ensures that covenant advice adequately incorporates climate-related risk factors where they are relevant and material. The RAC will monitor and review progress against the Fund’s climate change risk management objectives.

-

ESG Sub-Committee

Read more

The ESGC is responsible for supporting ALCO by developing and overseeing the approach to responsible ownership and climate risk management and reporting (described further in Role of the ESG Sub-Committee).

Trustee’s update

The Trustee completed training in May 2022 on the importance of climate-related risk governance and reporting.

The Trustee collected additional carbon data, including Scope 3 emissions and portfolio alignment metrics from its investment managers to meet the additional requirement under the TCFD framework. The Trustee has considered the responses which will be covered later in this report.

Later in the month, the ESGC met to review and challenge carbon data provided by the managers. The Trustee notes that while the data received has improved, there is not yet an industry-wide standard on calculating some of the metrics.

These issues are common across the industry at the current time and highlight the importance of TCFD-aligned reporting to improve transparency. The Trustee expects that in the future better information will be available from managers as the industry aligns to expectations and best practice standards.

When working with its investment advisers, the Trustee sets clear expectations around the need to bring important and relevant climate-related issues and developments to the Trustee’s attention in a timely manner.

Over the year, the Trustee dedicated circa 24 hours of management time and resource on governance of climate-related risks and opportunities, which involved working closely with RIEL and its investment advisers.

Role of the ESG Sub-Committee

The overriding responsibility of the ESGC is to oversee and support ALCO and the Trustee Board on all responsible ownership matters, including engagement, climate change risk and compliance with mandatory climate disclosure requirements. The ESGC reports to the ALCO, which then reports to the Trustee.

Read more

The ESGC meets and reports to the Trustee on at least a quarterly basis and ad-hoc as required to address ESG (including climate-related) risk and opportunities for the Fund. With the support of the Trustee’s advisers, and the engagement partner, the ESGC is responsible for the following key activities:

- Ensuring climate risks and opportunities are considered in the management of the Fund.

- Regularly reviewing the ROP and proposing any changes to ALCO; approving annual engagement activity which is carried out by the Fund’s engagement partner.

- Identifying any risks that could impact the Trustee’s adherence to the ROP and on identification, recommending any remedial actions; ensuring such risks and actions are notified to the RAC.

- Ensuring that stewardship activities are being undertaken appropriately on the Fund’s behalf.

- Strategic decisions in relation to the Trustee’s disclosures on climate, ESG and responsible ownership matters.

- Working with investment managers to disclose relevant climate-related data as required by the TCFD recommendations.

How we work with our advisers and relevant stakeholders

RIEL maintains a regular dialogue with our advisers and investment managers to ensure we identify any important climate-related issues and developments in a timely manner. We expect our advisers and investment managers to have the appropriate knowledge on climate-related matters.

-

RBS Investment Executive Limited

Read more

Is responsible for:

- Advising the Trustee on its long-term objectives and strategy and supporting the implementation of that strategy with delegated responsibility in relation to investment management.

- Reviewing all significant asset purchases, including reviewing whether they are more at risk of climate change or represent a climate opportunity.

- Responsible for oversight of fund manager activities and reporting including climate reporting.

- Responsible for agreeing the exclusions list at asset level, subject to policy decisions taken by the ESGC.

- Reporting to the ALCO annually on the implementation of the ROP.

-

Aon Investments Limited (Aon)

Read more

Provide reporting support to the Trustee in respect of climate-related risks and opportunities and ensuring compliance with the recommendations set out by the Regulations. The Trustee regularly assesses its consultants on their ability to carry out climate-related risk and opportunities assessment for the Fund’s assets, through competency-based questions and consultants’ prior experience.

-

Engagement partner and voting adviser

Read more

EOS at Federated Hermes (EOS) provides engagement services for the Fund’s listed investments which now mainly comprise investment grade corporate bonds but little or no quoted equities. It monitors the performance of companies against the United Nations Global Compact Principles, engages on relevant government policy initiatives and promotes collaboration between asset owners on behalf of the Trustee. EOS reports to the Trustee and RIEL on engagement activity. In turn, the Trustee monitors the engagement programme through review of EOS reporting which summarises key milestones achieved with underlying managers on a quarterly basis.

-

Scheme Actuary

Read more

We work with the Scheme Actuary to ensure that appropriate consideration is given to the impact of climate change on the valuation of the liabilities and on the key funding assumptions such as demographics and investment returns for the Main, AA, NWM and RBSI sections. Aon, as the Scheme Actuary, considers the extent to which climate change will impact on the actuarial assumptions as part of the triennial actuarial valuation process. The Scheme Actuary also considers the possible impact on the wider funding strategy, which is influenced by the results of climate change scenario analysis.

-

Covenant adviser

Read more

Our covenant adviser, Penfida Limited, provides advice on the ability of the sponsoring employers to continue to meet their obligations to the Fund taking account of all material risk factors, including climate risk.