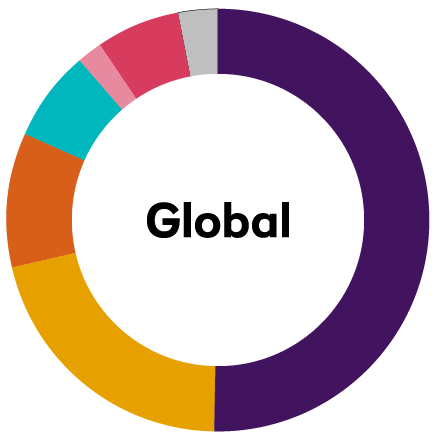

We engaged with 242 companies over the last year.

- Environmental 25.7%

- Social and Ethical 24.4%

- Governance 35.0%

- Strategy, Risk and Communication 14.9%

RBS Investment Executive Limited (RIEL) continued to work closely with investment managers on environmental, social and governance (ESG) issues in directly held real assets and in making investments and divestments in line with the Trustee’s Responsible Ownership Policy (ROP). This close collaboration ensures maximum impact for the Trustee. The Trustee has a significant portfolio of real assets. Some of these assets are wholly-owned and some are owned as a joint venture or minority interest. Through RIEL and its investment managers, the Trustee can take more direct action to address ESG issues and apply its ROP. Highlights of activity in the reporting period are as follows:

A new joint venture with Legal & General to develop retirement villages through Inspired Villages is an opportunity for the Trustee to use sustainable technologies in its real estate with ground source heat pumps and solar power key features of these developments and to create net-zero retirement communities.

Separately, the installation of a rapid electric vehicle (EV) charging point at the Urban Building, Slough achieved practical completion. It began operating in November 2021. The scheme delivers the first EV charging hub of its kind within a town centre on the outskirts of London with a total of 12 EV charging bays made up of 10 individual charging stations; 8 DC rapid charging and 2 dual-port AC slow/fast charging. The development will be open 24 hours, 7 days a week to the public. This scheme seeks to encourage local residents and workers to transfer from combustion to electric engines due to the knowledge that there is a nearby charging hub. The energy infrastructure required for the electric charging stations will be provided through excess capacity from the office building which enhances the sustainability of the scheme.

Vehicle recharging points at a retirement village which also uses solar power and ground source heat pumps.

Image by Inspired Villages.

Forestry investment manager New Forests is actively pursuing the design of a carbon project on the Fund’s US timber asset. The scheme will be regulated by the California Air Resources Board and will entail lower levels of harvest activity to maintain a higher level of stored carbon in the forest biomass – in return offset rights would be issued which can either be traded or held as financial assets. The project is expected to be submitted for regulatory approval in 2022.

The Fund’s shipping portfolio has benefited from technical solutions that promote fuel efficiency. Energy saving devices (ESDs) are being retrofitted on portfolio vessels. Based on preliminary tests, shipping manager Tufton expects a total of 8-10% fuel savings on two vessels fitted with these devices in 2021. Analysis of the fleet for other ESD opportunities continues. Examples of these devices include:

Sustainable biofuels reduce emissions and are expected to be a part of the shipping fuel mix in the medium term. Tufton successfully trialled sustainable biofuel on one of the Fund’s vessels and is in dialogue with charterers to extend the use of sustainable biofuel across the portfolio vessels.

The Trustee has exercised its ownership rights and engaged with investee companies in quoted equities and investment grade credit through its stewardship manager, EOS at Federated Hermes (EOS). Engagement work carried out with EOS is in collaboration with other EOS clients and is based on mutually agreed priorities in the EOS engagement plan.This is more efficient and effective than attempting to engage as an individual investor. Engagement in private investments takes place through the relevant investment managers or board representation.

The EOS Annual Voting and Engagement Reports for the Fund are made available on the Trustee website and a summary of this activity is set out in the Fund’s implementation statement. The key points to note from voting and engagement activity in 2020 and 2021 are set out below.

In 2021, we engaged with 242 companies on 1,132 environmental, social, governance, strategy, risk and communication issues and objectives. Our holistic approach to engagement means that we typically engage with companies on more than one topic simultaneously.

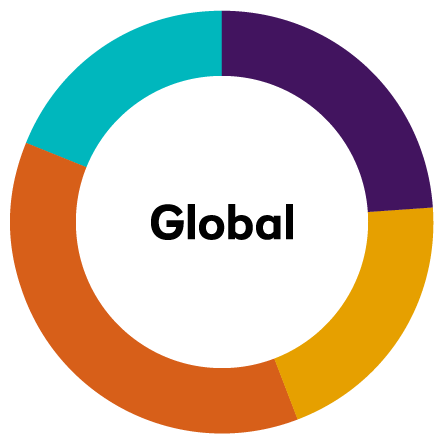

In 2020, we engaged with 274 companies on 1,193 environmental, social, governance, strategy, risk and communication issues and objectives. Our holistic approach to engagement means that we typically engage with companies on more than one topic simultaneously.

A more detailed analysis of the engagement issues and an analysis of progress on these issues over time, along with further case studies are included in the EOS annual reports. The focus of engagements reflects client priorities that are included in the engagement plan. The engagement process is monitored by EOS based on four milestones beginning with initial awareness and culminating in the implementation of a strategy to address the engagement issue. Milestone progress in the reporting period is shown below:

A more detailed analysis of the engagement issues and an analysis of progress on these issues over time, along with further case studies are included in the EOS annual reports. The focus of engagements reflects client priorities that are included in the engagement plan. The engagement process is monitored by EOS based on four milestones beginning with initial awareness and culminating in the implementation of a strategy to address the engagement issue. Milestone progress in the reporting period is shown below:

Significant engagement case studies for EOS in the reporting period include the following:

In response to the 2019 Climate Action 100+ shareholder resolution at oil and gas company BP, with engagement co-led by EOS, in February 2020 the company announced a new business purpose focused on “reimagining energy for people and our planet”. Importantly, this was accompanied by a new strategy, consistent with the goals of the Paris Agreement, plus 10 ambitions linked to achieving net-zero emissions by 2050 or earlier. Later in the year it followed up with more details including short and medium-term targets. The Fund does not own BP shares, but it owns BP debt so will have benefit from this engagement as a debtholder.

In 2020, EOS engaged with Tesco’s board – including the chair and audit committee chair – and were pleased with the changes made to the company’s culture and processes, particularly for financial reporting and audit. These include robust, centralised processes governing risk management, meaning that risks and opportunities are carefully considered. There is also a culture of transparency, with candid dialogue between executives and the board. EOS have been engaging with the company on these issues since the accounting scandal in 2014. EOS are satisfied with the effectiveness of the company’s changes, demonstrated through its response to the coronavirus pandemic in 2020. Improved risk management processes enabled a quick operational response, while the company’s culture enabled swift decision-making. The Fund owns real estate assets that are let to Tesco Plc.

Key voting policies were applied during the reporting period in an attempt to effect management change.

EOS saw 2021 as a tipping point for investor engagement and voting on climate change, with the emergence of 18 “say on-climate” proposals at companies spanning oil and gas, construction, aviation, and consumer goods. Whilst EOS were supportive of the idea in principle, they had some initial concerns about the concept. The high level of support for transition plans suggests these concerns were justified. EOS noted a tendency for investors to vote in line with management, which may suggest they do not have the technical skills or the time to evaluate plans properly.

EOS applied a rigorous approach in their assessment of transition plans, setting a robust standard of alignment with the Paris Agreement goals for companies to pass. They recommended support for proposals that demonstrated robust target-setting, and that were aligned with external frameworks and accreditations such as the Science-Based Targets initiative. They also wanted to see a clear and credible strategy in place to achieve the stated targets, as at Unilever, Aviva and Nestlé. However, they opposed the proposed climate plans at Shell, Glencore and Total Energies, as these did not appear to be aligned with the Paris Agreement goals. They also recommended opposing the plan at airport operator Aena, due to a lack of targets for the Scope 3 emissions that are critical to its transport infrastructure.

In 2021, shareholders in many countries were asked to vote on the decisions taken on executive pay for 2020, which heightened concern at EOS given the backdrop of Covid-19. A clear expectation was set that boards should continue to use their judgement to ensure that executive pay could be justified in the context of the experience of other stakeholders, particularly for companies that had made redundancies, benefited from government support, or were otherwise in distress.

Overall, EOS recommended a vote against 38% of pay proposals, compared with 35% in 2020. In the US, where it is believed there are substantial issues with executive pay practices, EOS opposed 88% of compensation proposals versus 81% in 2020. These concerns were exacerbated by decisions to insulate executives from the impacts of Covid-19, relative to other stakeholders.

At Disney, EOS recommended a vote against the say on-pay item and the compensation committee chair due to the high quantum of pay awarded to the CEO and executive chair. The company had not adequately adjusted the executive chair’s pay when he stepped down from his CEO role in 2020 and did not provide a justification for continuing to pay the executive chair above the market rate.

We recommended voting against or abstaining on 296 resolutions over the last year.

We recommended voting against or abstaining on 340 resolutions over the last year.