How long might you live?

It’s actually someone’s job to try to work this out! A typical 65-year-old, in good health, in December 2019 could expect to reach an age of:

So, if you retire at age 65, you could live for at least 20 years after that. That’s 20 years of paying for the things you’ll need and want.

To find out more about Life Expectancy and to use a tool to get an idea of your own personal life expectancy, visit this page of the site.

Why this option might suit you

Here’s a list of things this option does or doesn’t provide. Have a look through and see which suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Whilst you can withdraw regular amounts this income is not guaranteed to last you for the rest of your life and it’s your responsibility to make it last as long as you need it. You can, however, purchase an annuity at a later date with whatever is left. |

| Benefit: Pension increases to protect against inflation | Available with this option?Optional | Notes: You can increase the amount you withdraw to protect yourself against increases in the cost of living (inflation), by this we mean as the cost of things like fuel, bread, milk etc. go up, you can withdraw additional money, but it will run out quicker this way. You would need to manage your investment options and the amount you withdraw to make sure that you are protected against inflation. |

| Benefit: A pension for my spouse / partner on my death | Available with this option?No | Notes: You can pass on your drawdown account to your dependants when you die, but this is not the same as the regular income they could get if you choose a joint-life annuity. |

| Benefit: Something easy to manage | Available with this option?No | Notes: Drawdown requires you to manage your investments and your money, to make sure it lasts as long as you need it to. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You control how much you withdraw and when. You can take up to 25% (one quarter) of your pension savings as a tax-free cash lump sum when you retire or 25% of each withdrawal tax-free. See below for more details. |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your drawdown account to you dependants when you die (typically tax-free if you die before 75). |

| Benefit: The flexibility to change my income when I like / need | Available with this option?Yes | Notes: You control how much you withdraw and when. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: Any money not yet withdrawn will need to be invested. Your chosen drawdown provider will have various investment options for you to choose from. You should consider the impact of any ongoing investment and advice fees on your account and the money you can then withdraw. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Possibly | Notes: You control how much you withdraw and when, so if you manage your money carefully and your investments perform as expected, it could last a long time, but there are no guarantees. There is a chance your money could run out while you are still alive. |

Tax

Tax-free income

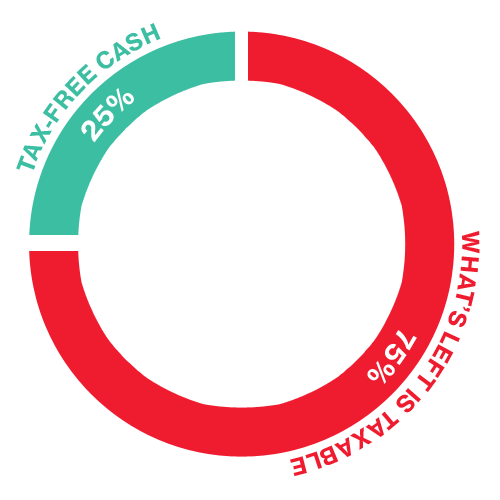

- You can take up to 25% of your pension savings as a tax-free cash lump sum

- If you die before age 75, you can generally pass your savings to your spouse or dependant(s) tax free.

Income subject to tax

- Withdrawals above your tax-free cash allowance will be taxed at your marginal rate of income tax for the year in which you make the withdrawal

- You won’t pay tax on investment returns within your Drawdown account

- On death after 75, the savings remaining can be drawn down or paid as a lump sum, taxed at your spouse or dependant’s marginal rate.

When should you take tax-free cash with drawdown?

When you enter drawdown, you have the option to either take 25% of your transfer value up front as a tax-free cash lump sum, or you can take a quarter (25%) of each withdrawal you make tax-free. Whether you choose one way or the other will depend on your personal circumstances and tax position, so it’s worth speaking to a financial adviser for advice.

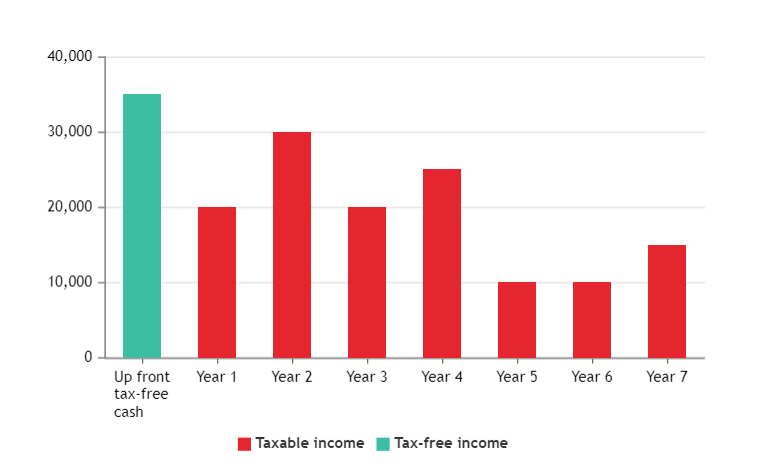

One-off tax-free cash up-front – 25% of your pension savings

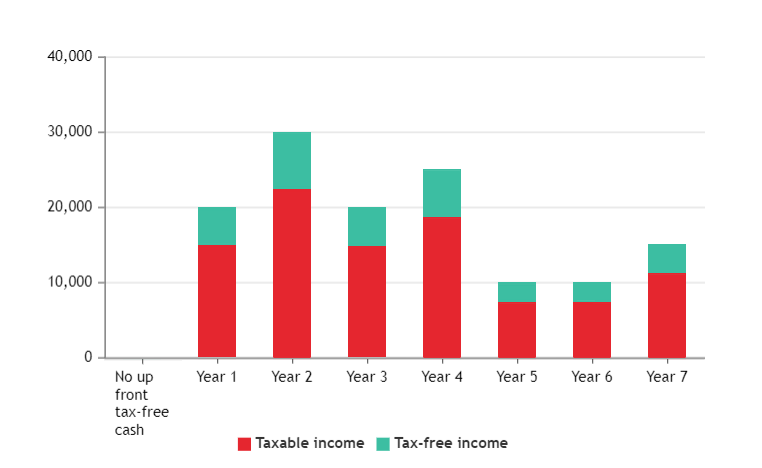

No up-front cash. 25% tax-free cash from each withdrawal instead

Future pension savings – warning!

Once you have started to take taxable withdrawals, the amount that you (and your employer on your behalf) can save into a defined contribution pension in future without incurring a tax charge will reduce to £4,000 a year, due to a restriction known as the Money Purchase Annual Allowance.

You will need to consider this if you are planning to contribute to a pension in future.

You will need to make sure that you tell any other defined contribution pension arrangements that you are continuing to save into that you are subject to the Money Purchase Annual Allowance so that they can assess your contributions against this lower level.

To assist you with this notification, your pension provider should send you a ‘flexible-access statement’ within 31 days of you first taking a taxable withdrawal. You will then need to let your other pension providers know within 13 weeks of receiving your ‘flexible-access statement’, or within 13 weeks of starting to make new contributions to a defined contribution pension, otherwise you may be subject to a fine.

How do you move into Drawdown?

We don’t offer drawdown directly through the Plan. So if you want to use drawdown you will need to transfer into a pension arrangement which does offer this. The Trustees can put you in contact with a Drawdown provider to facilitate this option for you at retirement, it is called LifeSight, which is provided by the Plan’s administrator, WTW. You can read more about LifeSight here. However, while the Trustees believes this should offer good value to many members, this arrangement will not be the most appropriate for everyone, and you are under no obligation to use this. It’s important to consider your personal circumstances before you make a decision. There are many different drawdown arrangements available. You can find a list of available providers on the Money and Pensions Service website here