Transfer and choose to take a bit at a time (drawdown)

At a glance

If you choose to transfer out of the Company Pension and invest your transfer value into a drawdown fund, you’ll have:

- a fund – where your transfer value is invested to give them a chance to potentially grow, and you can take your money as and when you need it (withdrawals are subject to tax, investment growth is not) until it runs out

- tax-free cash – the option to take up to 25% of your transfer value as a tax-free cash lump sum at the point you retire or to take 25% of each withdrawal tax-free

- legacy options – the ability to pass on your drawdown fund to your dependants when you die

- the option to buy an annuity at a later date – with whatever savings you have left in your drawdown fund, you can choose to buy a regular income for the rest of your life, called an Annuity

- to take investment risk, pay ongoing investment and potentially advice charges.

PRIVANI’S CHOICE

Privani wanted flexibility to take her money a bit at a time, changing how much she took and when. After taking financial advice and confirming that this was the right thing to do, she transferred out of the Company Pension and took Drawdown.

Privani is used to making investment decisions and knows about the ongoing investment charges. She has a guaranteed income, from other sources to meet her basic needs.

Why this option might suit you

Here is a list of characteristics that this option provides or doesn’t provide. Have a look through and see if these characteristics suit your personal circumstances. You may be required to take financial advice to access these options.

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Whilst you can withdraw regular amounts this income is not guaranteed to last you for the rest of your life and it’s your responsibility to make it last as long as you need it. You can, however, purchase an annuity at a later date with whatever is left. |

| Benefit: Pension increases to protect against inflation | Available with this option?Optional | Notes: You can increase the amount you withdraw to protect yourself against increases in the cost of living (inflation), by this we mean as the cost of things like fuel, bread, milk etc. go up, you can withdraw additional money, but it will run out quicker this way. |

| Benefit: A pension for my spouse, partner or financial dependant on my death | Available with this option?No | Notes: You can pass on your drawdown fund to your dependants when you die, but this is not the same as the regular income they could get if you choose the Company Pension or a joint-life annuity. |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your drawdown fund to your dependants when you die (typically tax-free if you die before 75). |

| Benefit: Something easy to manage | Available with this option?No | Notes: Drawdown requires you to manage your investments and your money, to make sure it lasts as long as you need it to. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You control how much you withdraw and when. You can take up to 25% (one quarter) of your transfer value as a tax-free cash lump sum when you retire or 25% of each withdrawal tax-free. See below for more details. See ‘When should you take tax-free cash with drawdown?’ below for more details. |

| Benefit: The flexibility to change my income when I like / need | Available with this option?Yes | Notes: You control how much you withdraw and when. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: Any money not yet withdrawn will need to be invested. Your chosen drawdown provider will have various investment options for you to choose from. You should consider the impact of any ongoing investment and advice fees on your fund and the money you can then withdraw. Investments, and any income from them, can go down as well as up and you may be able to withdraw less than you started with. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Possibly |

Notes: You control how much you withdraw and when, so this depends on how you manage your money, how your investments perform, how much you withdraw each year and how long you live. |

Tax

Tax-free income

- You can take up to 25% of your pension savings as a tax-free cash lump sum

- If you die before age 75, you can generally pass your savings to your spouse or dependant(s) tax free.

Income subject to tax

- Withdrawals above your tax-free cash allowance will be taxed at your marginal rate of income tax for the year in which you make the withdrawal

- You won’t pay tax on investment returns within your Drawdown account

- On death after 75, the savings remaining can be drawn down or paid as a lump sum, taxed at your spouse or dependant’s marginal rate.

When should you take tax-free cash with drawdown?

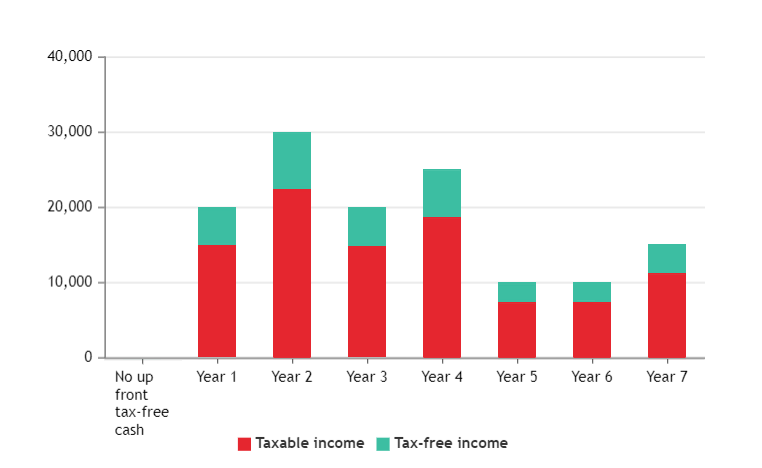

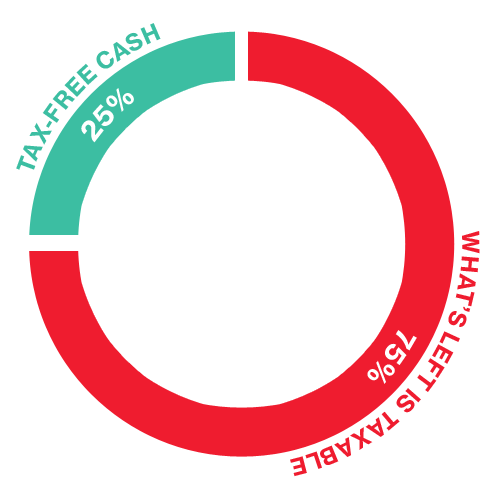

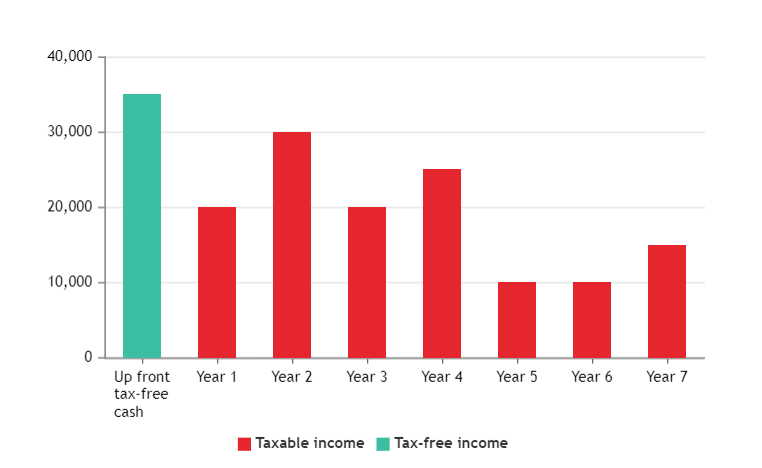

When you enter drawdown, you have the option to either take 25% of your transfer value up front as a tax-free cash lump sum, or you can take a quarter (25%) of each withdrawal you make tax-free. Whether you choose one way or the other will depend on your personal circumstances and tax position, so it’s worth speaking to a financial adviser for advice.

One-off tax-free cash up-front – 25% of your pension savings

No up-front cash. 25% tax-free cash from each withdrawal instead