Take your company pension

At a glance

The Pensions Regulator believes, for most members, it’s likely in their best financial interests to take your Company Pension. If you choose to take your Company Pension, you’ll have:

- A pension at retirement

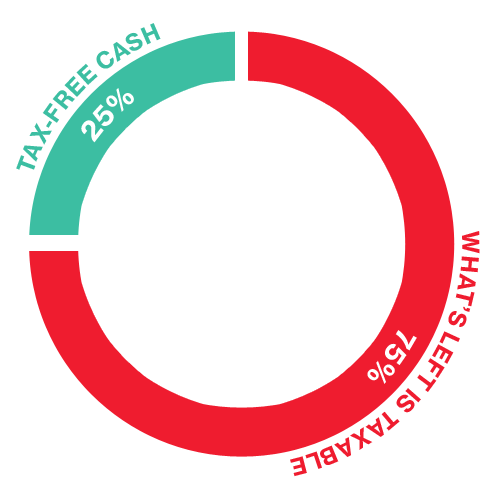

- Tax-free cash – the option to exchange part of your Company Pension for a tax-free cash lump sum (usually up to 25% of your total pension value) in return for a smaller monthly pension

- Yearly increases to parts of your pension, in line with the Company Pension rules to protect against increases in the cost of living (inflation)

- A pension for your spouse, partner of financial dependant on your death, based on a percentage of your pension, in line with the Company Pension rules

- A lump sum payable to your spouse, partner or financial dependant if you die within 5 years of retiring, in line with the Company Pension rules

SALLY’S CHOICE

For Sally, a pension that could provide a regular income for life for her, and her husband Jim if she died first, and which provided protection against future increases in the costs of living, gave her the peace-of-mind she needed. So, she decided not to transfer out and took her Company Pension.

Please note: Sally’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Why this option might suit you

Here is a list of characteristics that this option provides or doesn’t provide. Have a look through and see if these characteristics suit your personal circumstances. For example, is the reassurance of a regular income for the rest of your life a priority or would you rather withdraw money as and when you need to?

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?Yes | Notes:

Taking your Company Pension gives you the reassurance of a regular income paid, normally monthly, to you for as long as you live, a bit like your salary is now. This is particularly useful if:

|

| Benefit: Pension increases to protect against inflation | Available with this option?Yes | Notes: Parts of your Company Pension increase in value each year to protect you against increases in the cost of living (inflation). By this we mean as the cost of things like fuel, bread, milk etc. go up, so does your pension income. |

| Benefit: A pension for my spouse, partner or financial dependant on my death | Available with this option?Yes | Notes: Your Company Pension will provide an income to your spouse, partner of financial dependant when you die, giving additional reassurance for you and your loved ones. |

| Benefit: Leaving an inheritance | Available with this option?No | Notes: You will receive a pension for your spouse, partner or financial dependant as outlined above. If you die within the first five years of retirement, a lump sum will be paid equivalent to the remaining pension instalments which would have been paid for those five years (without increases). |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: Super easy, you don’t have to do anything, your pension will be paid to you regularly, just like your salary is now. |

| Benefit: Money to use now | Available with this option?Yes | Notes: In exchange for a reduced regular income from the Company Pension, you can take up to 25% of the value of your pension as a tax-free cash lump sum when you retire. |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: There is no flexibility to change your income from the Company Pension once you retire - only the annual increases change the amount you receive. |

| Benefit: The ability to invest my money myself | Available with this option?No | Notes: There is no option to manage any investments. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Yes | Notes: Definitely. Your Company Pension will be paid to you for as long as you live. It’s worth noting that on average (based on national figures from the Office for National Statistics) we’ll live until our mid-80s, however there’s a 1 in 4 chance you’ll live in to your 90s and 3 in every hundred people retiring now will live to be 100 years old. |

Tax

Tax-free cash lump sum

- You can take some of your Company Pension as tax-free cash (up to a maximum permitted by HMRC)

- The amount of the tax-free cash lump sum depends on the terms offered by the Company Pension.

Income subject to tax

- Your annual income will be taxed at your marginal rate of income tax for that year

- As your pension income is stable, you can expect to pay a similar level of tax each year (subject to any other income you have).