Transfer and choose to take it all as cash

At a glance

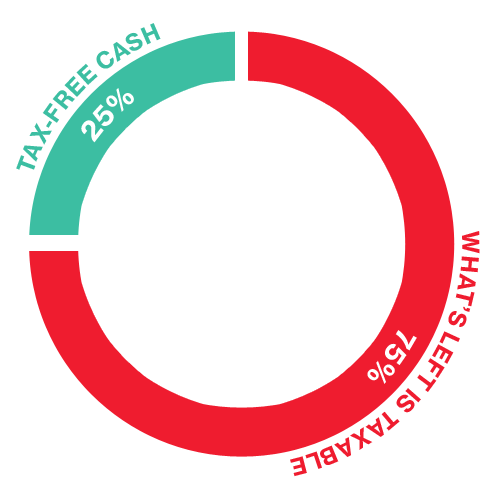

If you choose to transfer out of the Company Pension and take a cash lump sum, you’ll have:

- a single cash lump sum – your transfer value

- tax-free cash – the option to take up to 25% of your transfer value as a tax-free cash lump sum at the point you retire

- to pay tax on the remainder of your cash lump sum

- no guaranteed income for your retirement

BEN’S CHOICE

Because Ben had other retirement savings, which would provide him with more than sufficient income in retirement, he wanted to take this pension as a cash lump sum. So, after taking financial advice, he transferred out of the Company Pension, took a cash lump sum and used the money, after tax, to enjoy his hobbies.

Ben’s choice is just an example and does not suggest a particular option that you should choose yourself. Please look at all of the options available to you and consider seeking independent financial advice before making any decisions about your own benefits.

Why this option might suit you

Here is a list of characteristics that this option provides or doesn’t provide. Have a look through and see if these characteristics suit your personal circumstances. You may be required to take financial advice to access these options.

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Taking a single cash lump sum will not provide you with the reassurance of a regular income for life. |

| Benefit: Pension increases to protect against inflation | Available with this option?No | Notes: You will not have any guaranteed protection against increases in the cost of living (inflation). |

| Benefit: A pension of my spouse, partner or financial dependant on my death | Available with this option?No | Notes: You can leave any leftover money to your spouse, partner or financial dependant but there is no pension payable to them. |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your remaining money to your dependants when you die. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: If you don’t invest the money. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You get all of it (some of which is subject to tax and you may get a large tax bill). |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: It's a single cash lump sum. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: You can choose to invest any of your money through self-investment. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Unlikely | Notes: You control how much you spend over time, so this depends on how you manage your money and how long you live. It’s worth noting that on average (based on national figures from the Office for National Statistics) we’ll live until our mid-80s, however there’s a 1 in 4 chance you’ll live in to your 90s and 3 in every hundred people retiring now will live to be 100 years old. |

Tax

Tax-free income

- You can take some of your benefits as tax-free cash (usually up to 25% of your transfer value).

Income subject to tax

- The remainder of your cash lump sum is taxed at your marginal rate of income tax for that year

- Taking all of your benefits as a single cash lump sum is likely to increase the amount of tax you pay as the lump sum will increase your income in the year you take your benefits

- You may need to pay further tax charges on any investment returns generated by investing the cash lump sum outside of a pension / drawdown arrangement.