Transfer out and buy a regular income for life from an insurance company

At a glance

If you choose to transfer out of the Company Pension and buy a regular income from an insurance company, known as an annuity, you’ll have:

- A guaranteed income for the rest of your life – you can choose the level of benefits and cover you need to match your priorities

- Tax-free cash – the option to take up to 25% of your transfer value as a tax-free cash lump sum

- Optional ill health annuity if you have recognised health issues, you are a smoker, drinker, have high blood pressure etc. This means you could get a higher income and is known as enhanced terms

- Optional yearly increases to your income to protect against increases in the cost of living (inflation), in exchange for a lower starting income, known as an increasing annuity

- Optional pension for your spouse, partner or financial dependant (your spouse, civil partner, partner and/or children) on your death, in exchange for a lower regular income, known as a joint life annuity

- Optional lump sum payable to your spouse, partner or financial dependant if you die soon after retirement, known as a guarantee period

HAROLD’S CHOICE

What was important to Harold was a regular income each month, similar to the Company Pension, but tailored to better suit his circumstances. Harold took financial advice and was recommended to transfer out of the Company Pension and buy an annuity from an insurance company.

Why this option might suit you

Here is a list of characteristics that this option provides or doesn’t provide. Have a look through and see if these characteristics suit your personal circumstances. You may be required to take financial advice to access these options.

| Benefit | Available with this option? | Notes |

|---|---|---|

| Benefit: The reassurance of a regular income for life | Available with this option?No | Notes: Taking a single cash lump sum will not provide you with the reassurance of a regular income for life. |

| Benefit: Pension increases to protect against inflation | Available with this option?No | Notes: You will not have any guaranteed protection against increases in the cost of living (inflation). |

| Benefit: A pension of my spouse, partner or financial dependant on my death | Available with this option?No | Notes: You can leave any leftover money to your spouse, partner or financial dependant but there is no pension payable to them. |

| Benefit: Leaving an inheritance | Available with this option?Yes | Notes: You can pass on your remaining money to your dependants when you die. |

| Benefit: Something easy to manage | Available with this option?Yes | Notes: If you don’t invest the money. |

| Benefit: Money to use now | Available with this option?Yes | Notes: You get all of it (some of which is subject to tax and you may get a large tax bill). |

| Benefit: The flexibility to change my income when I like / need | Available with this option?No | Notes: It's a single cash lump sum. |

| Benefit: The ability to invest my money myself | Available with this option?Yes | Notes: You can choose to invest any of your money through self-investment. |

| Benefit: Suitable if I expect to live a long time | Available with this option?Unlikely | Notes: You control how much you spend over time, so this depends on how you manage your money and how long you live. It’s worth noting that on average (based on national figures from the Office for National Statistics) we’ll live until our mid-80s, however there’s a 1 in 4 chance you’ll live in to your 90s and 3 in every hundred people retiring now will live to be 100 years old. |

Income for life (annuity) options

What are your options if you buy a regular income for life (an annuity)?

| Feature | Option 1 | Option 2 | Comparison |

|---|---|---|---|

| FeaturePension increases | Option 1An income which increases during retirement, either at a fixed rate or based on inflation. This is known as an ‘increasing annuity’. |

Option 2An income which remains level throughout retirement. This is known as a ‘level annuity’. |

Comparison

|

| FeatureSpouse / partner pension | Option 1An income which continues to be paid to your spouse, partner or finanical dependant upon your death (at a reduced level). This is known as an ‘joint life annuity’. |

Option 2An income which ceases on your death. This is known as a ‘single life annuity’. |

ComparisonAn annuity which includes an income for your spouse, partner or finanical dependant after your death will be lower than an annuity paid just to you, as it is expected to be paid for longer. |

| FeatureGuarantee period | Option 1An income which stops on your death (or the death of your spouse, partner or finanical dependant). This is known as an annuity with ‘no Guarantee period’. |

Option 2An income which is guaranteed to be paid for a minimum period. This is known as an annuity with a ‘Guarantee period’. |

Comparison

|

| FeatureHealth / enhanced terms | Option 1An income which does not take into account your health or lifestyle. This is known as a ‘standard annuity’. |

Option 2An income which takes into account your health or lifestyle. This is known as an ‘enhanced annuity’. |

Comparison

|

How do I buy an annuity?

Different annuity providers offer different rates for different types of annuity. So, you may be able to secure a higher income, or an income that better suits your needs, by shopping around. This is often referred to as an ‘Open Market Option’. You can shop around yourself, or you can use an annuity comparison service. You can compare different annuities on the MoneyHelper website.

Tax

Tax-free cash lump sum

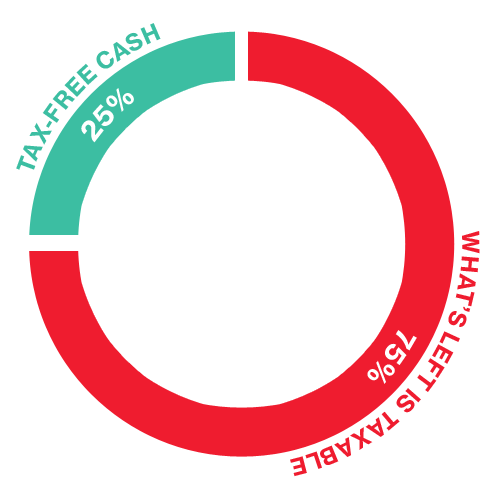

- You can take some of your transfer value as tax-free cash (usually up to 25% of your transfer value)

Income subject to tax

- Your annual income will be taxed at your marginal rate of income tax for that year

- As your annuity income is stable, you can expect to pay a similar level of tax each year (subject to any other income you have).